To the Limited Partners of the Ewing Morris Flexible Fixed Income Fund:

If 2023 had a theme, Growth was it. In 2023, we grew your capital. Our capacity to create value in credit also grew. But these are just words on a page. Let's explore the facts on the ground.

Growing Your Capital in 2023

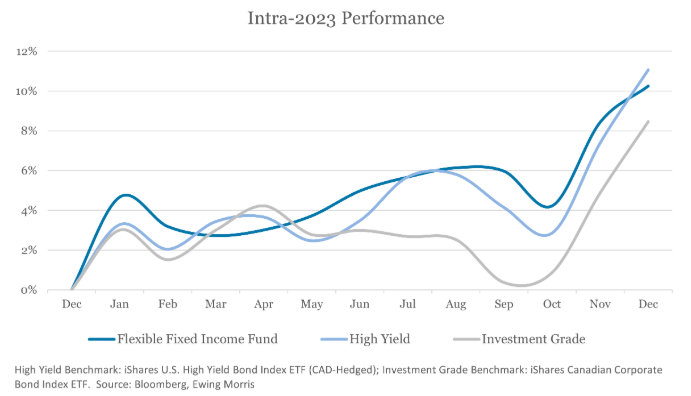

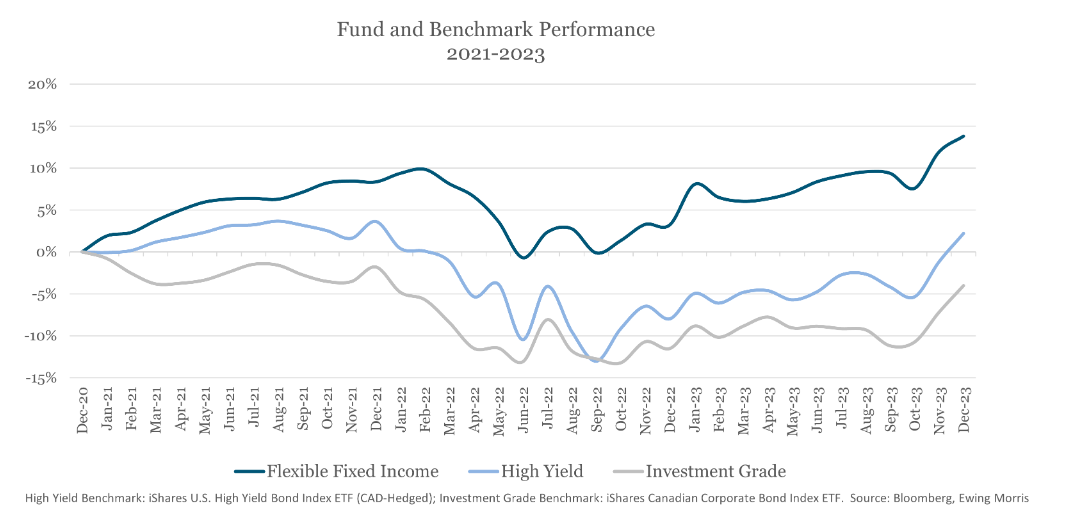

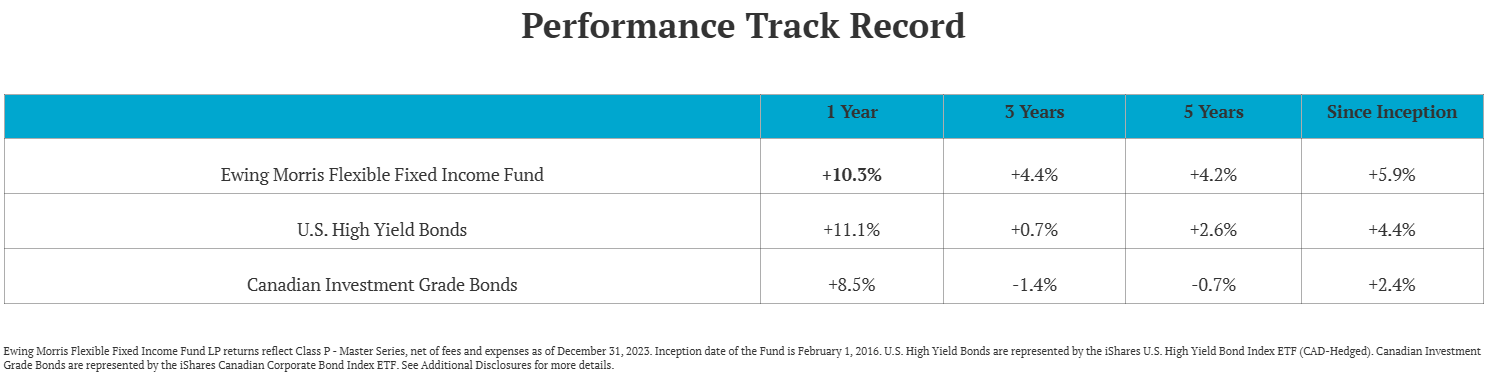

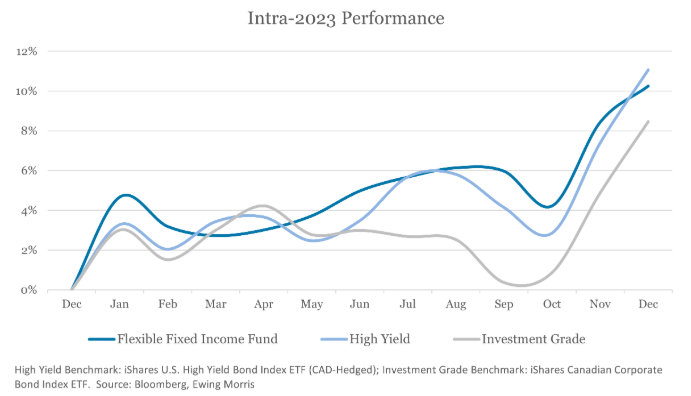

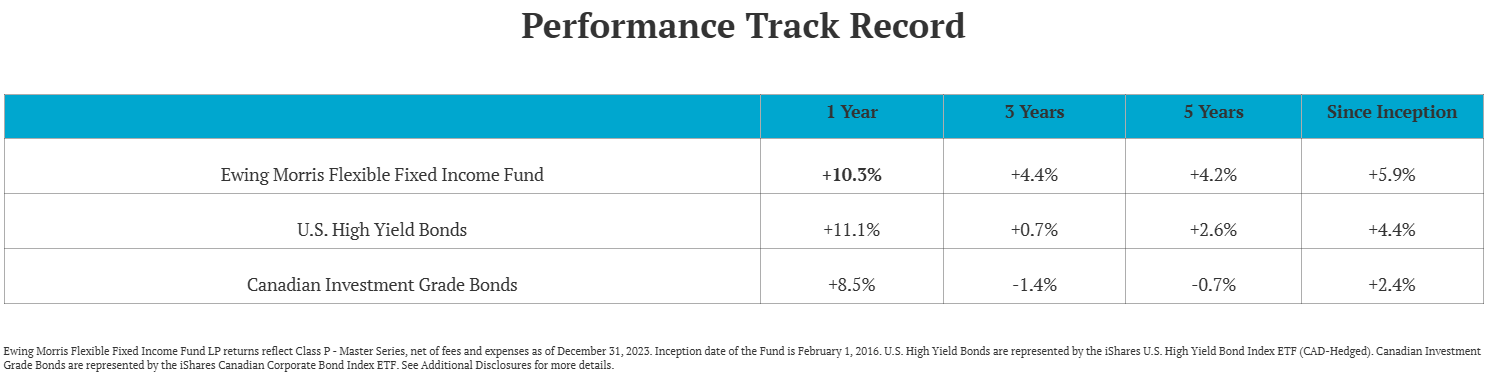

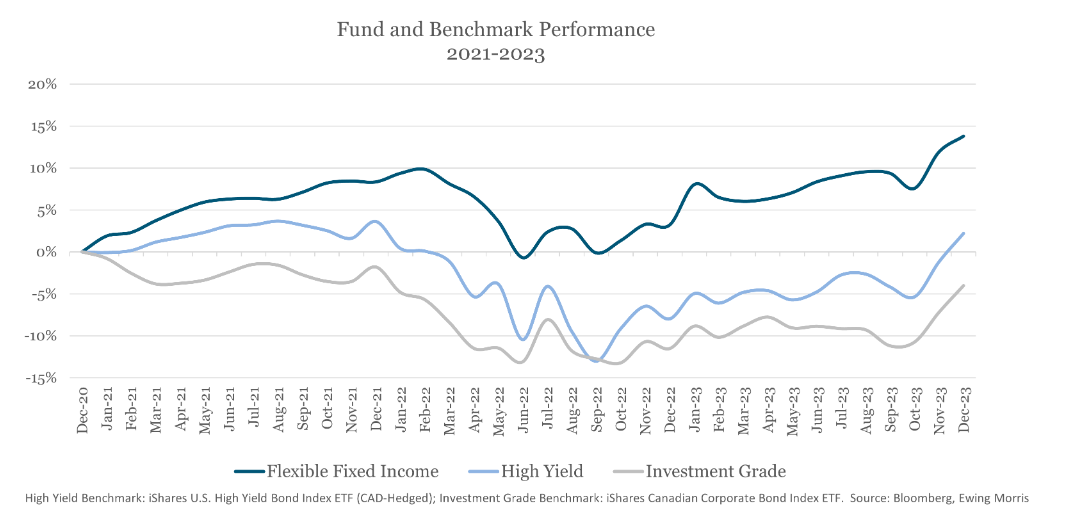

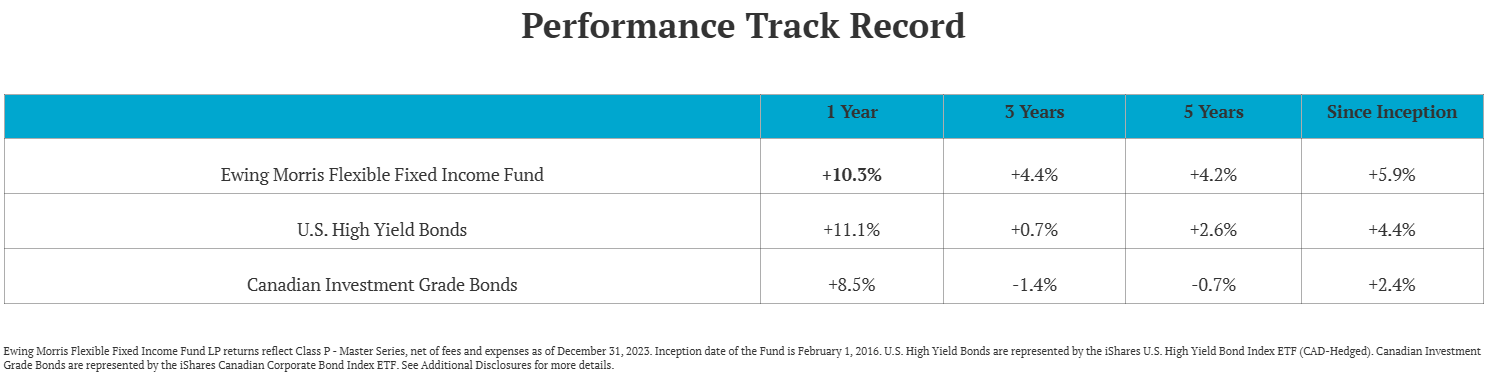

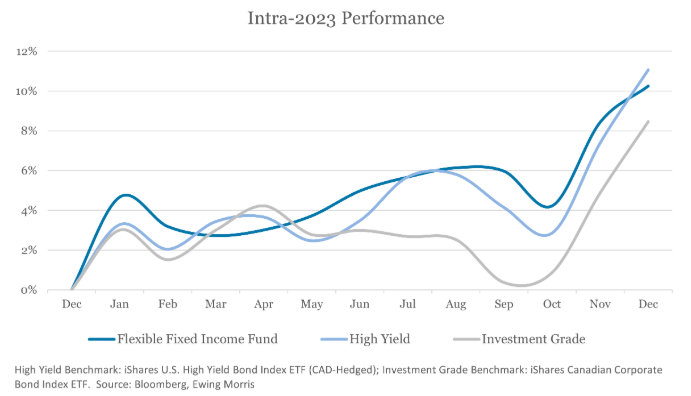

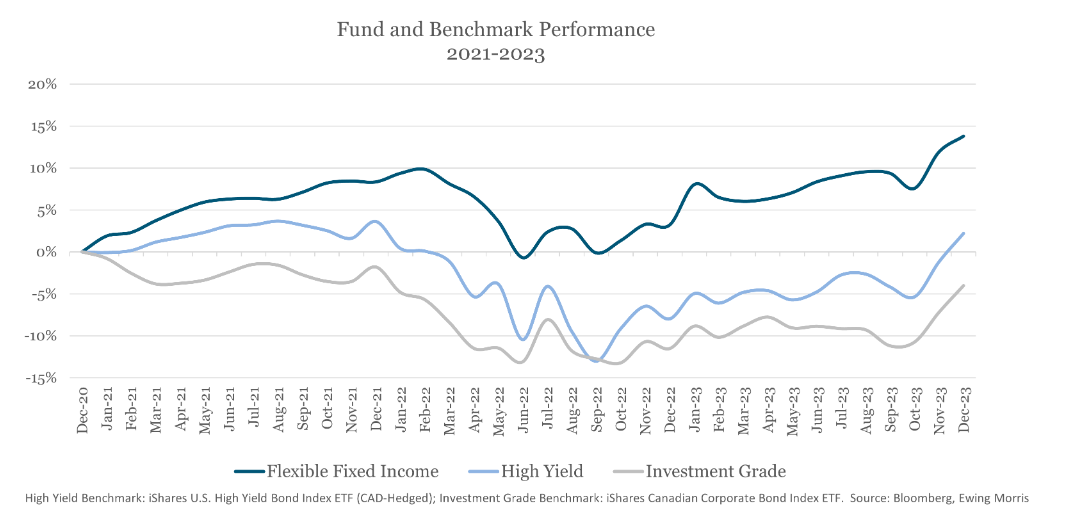

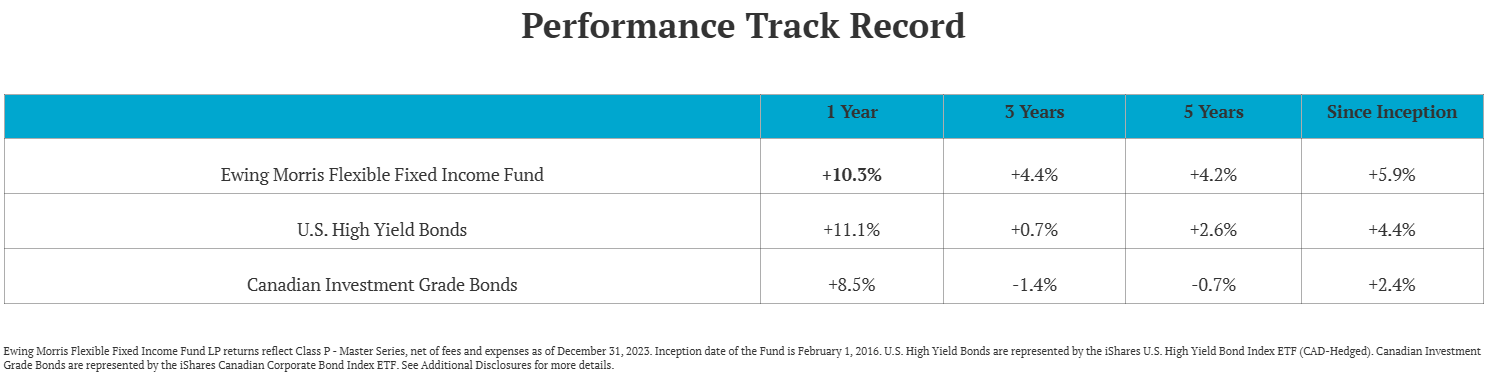

Growth of your invested capital is our foremost concern. To this end, 2023 was a successful year as the Fund returned +10.3%.*

*All Fund returns referenced reflect Class P returns, net of all fees and expenses.

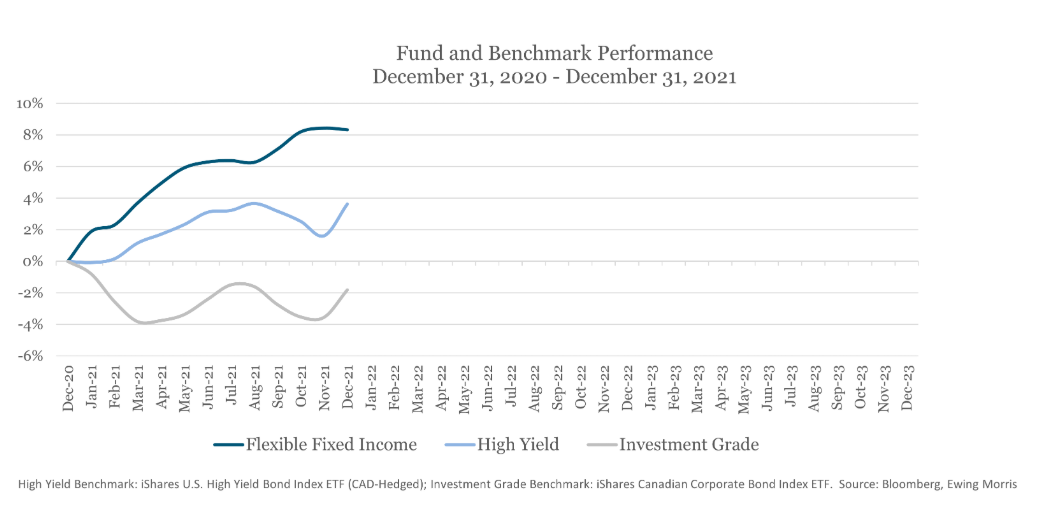

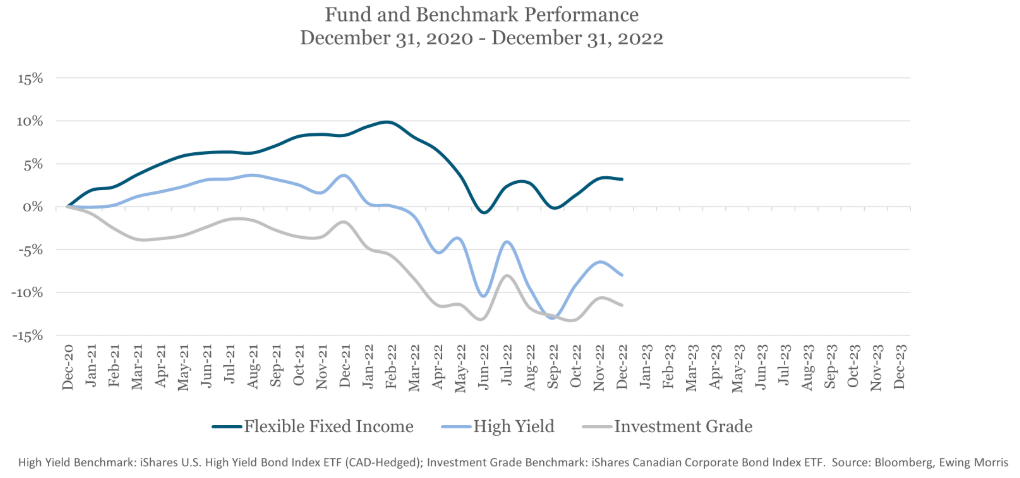

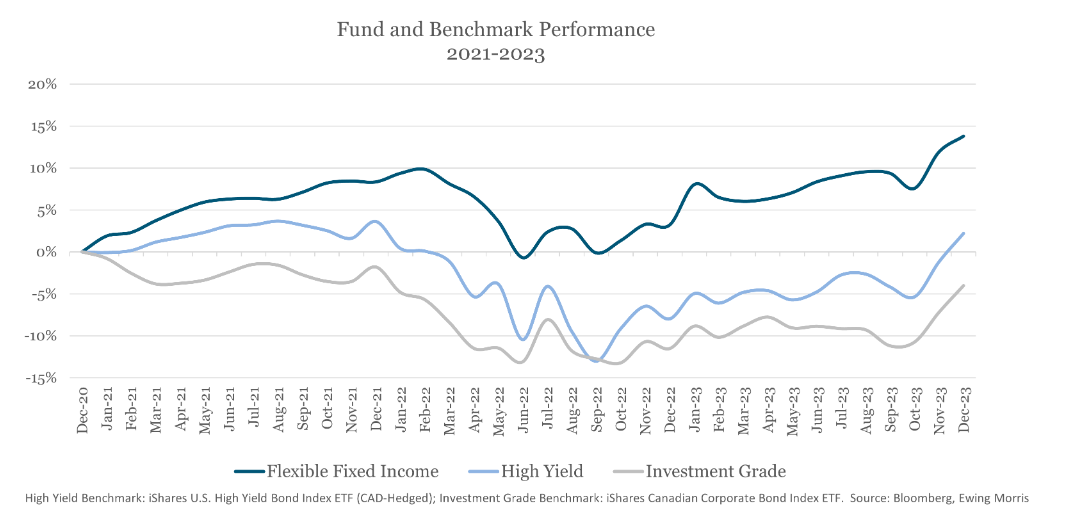

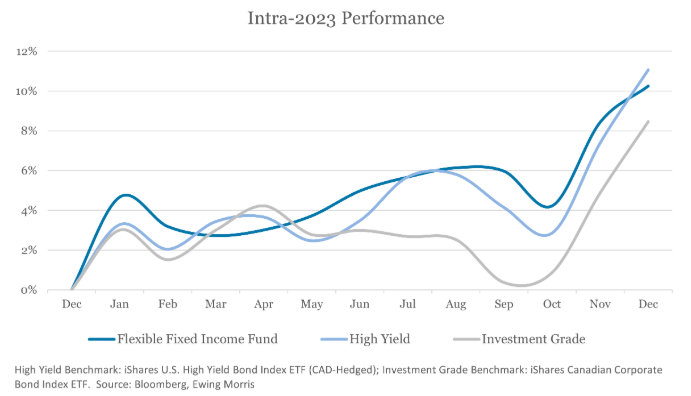

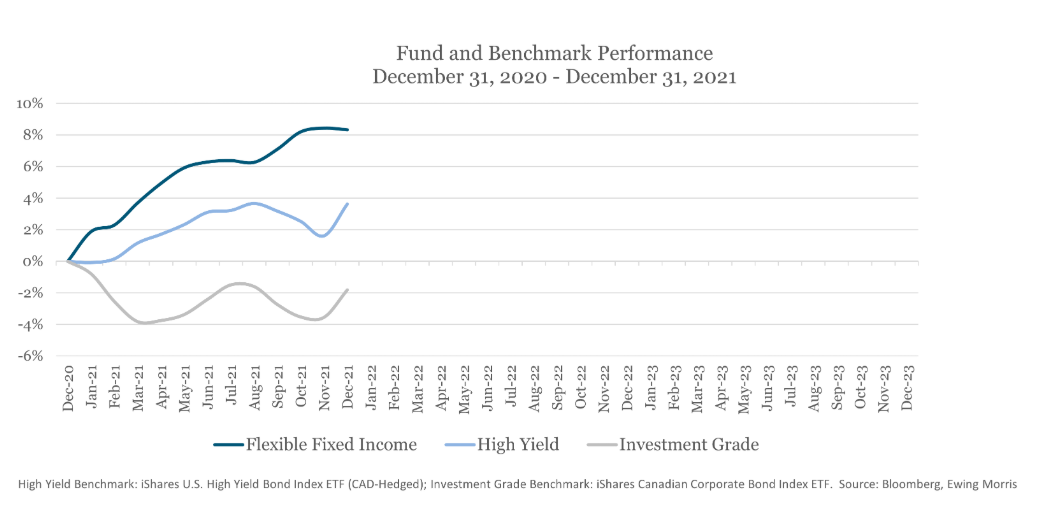

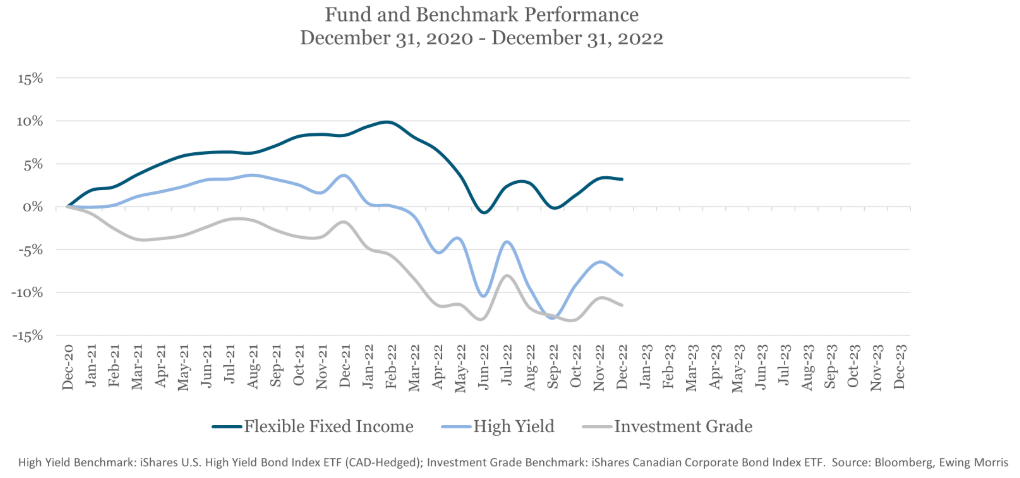

On a relative basis, the Fund outpaced its High Yield and Investment Grade benchmarks for the majority of the year. As the year finished, Fund returns were overtaken by the High Yield benchmark, as all asset classes staged a pronounced rally following the dovish Federal Reserve meeting in early November.

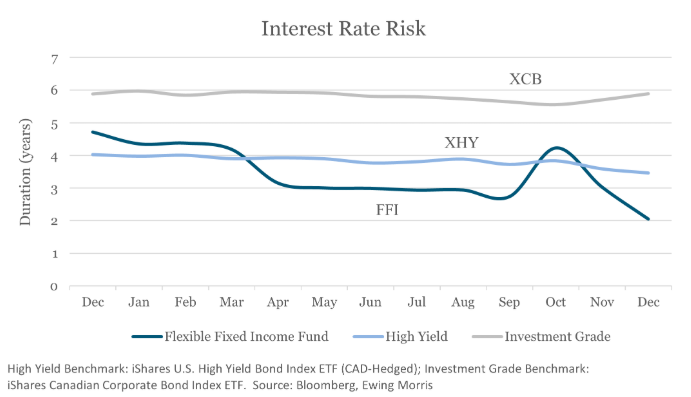

2023 was not a year where a cautious approach was rewarded. It was a year where corporate bonds that had more risk of any kind - credit or interest rate - performed the best. Although exposures varied through the year, on average, the Fund was positioned with less credit and interest rate risk than the high yield and investment grade benchmarks, respectively.

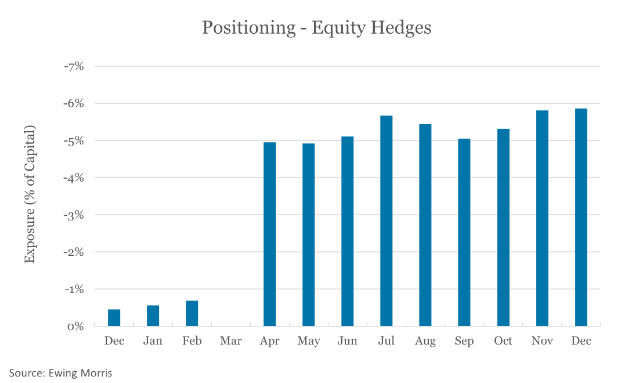

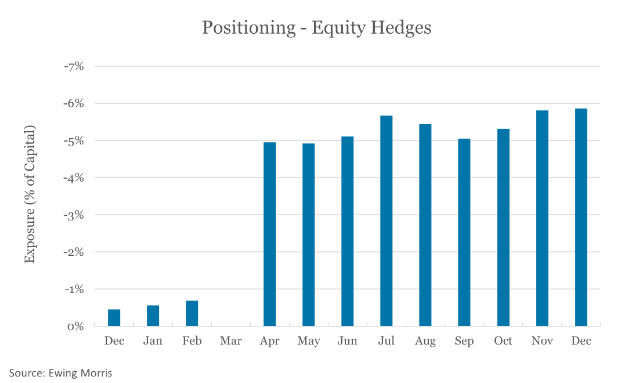

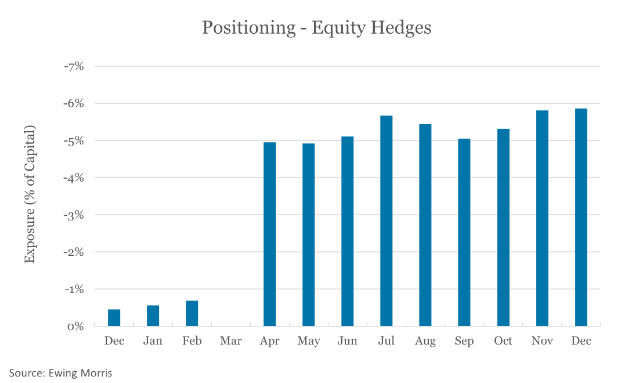

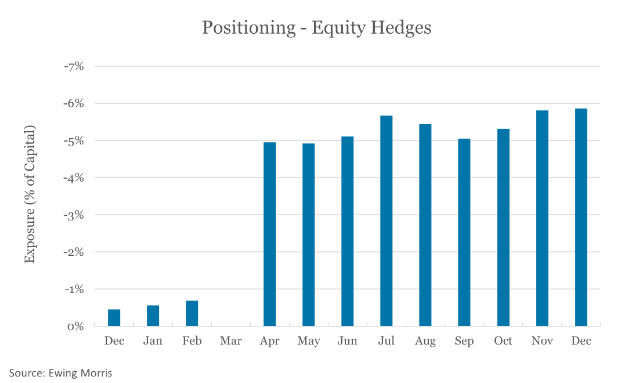

From a credit perspective, the portfolio held no CCC exposure and carried equity hedges for the majority the year. Both of these attributes positioned the fund to preserve capital in the event of a hard landing.

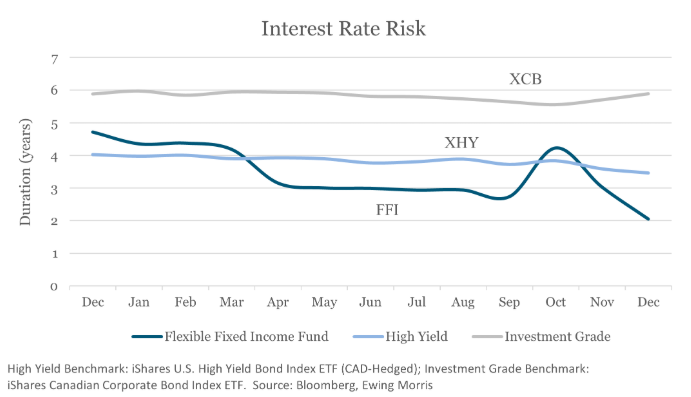

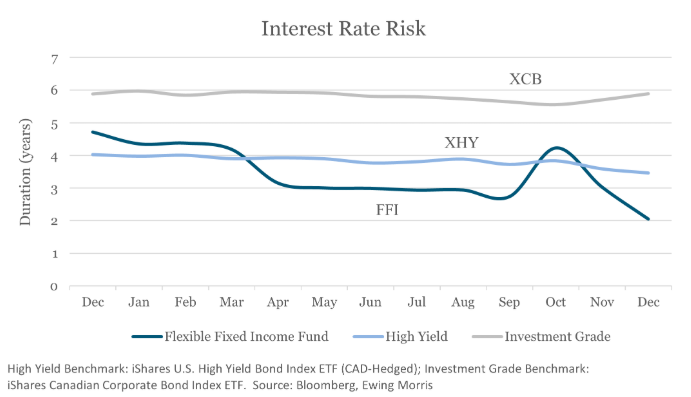

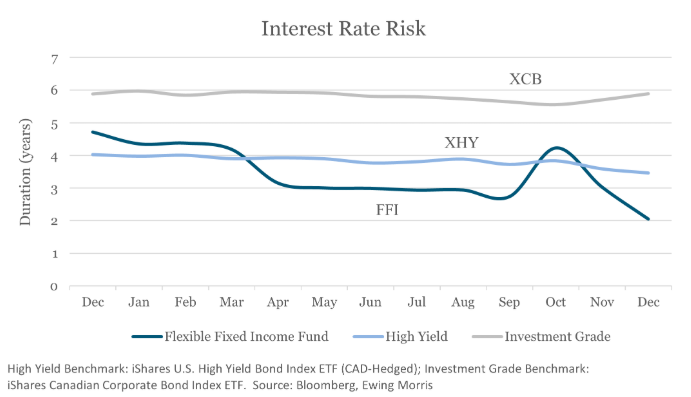

From an interest rate risk perspective, the fund had substantially lower duration than the investment grade market and averaged lower duration than the high yield market in the year.

In spite of its more conservative positioning, the Fund outperformed its investment grade benchmark for the full year and largely kept pace with its high yield benchmark. This performance was principally due to strong security selection, our core discipline. We had no meaningful mishaps in the year and for the first time, on an outright basis, we allocated capital to the "highest quality" asset class: US Treasuries. The price paid: ~44 cents on the dollar. This was an astonishing reminder that what drives a AAA investment outcome is not a bond's rating. It's a bond's price.

Looking Back

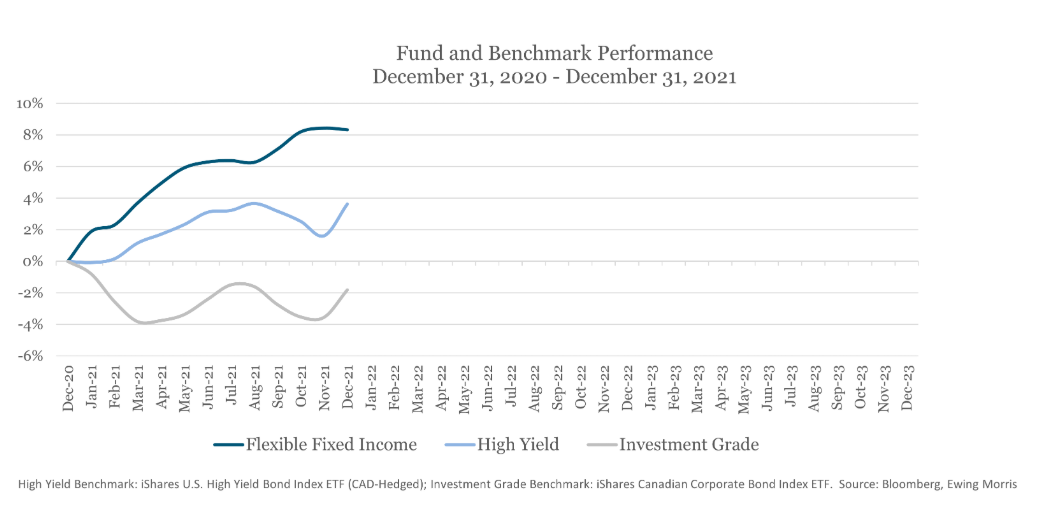

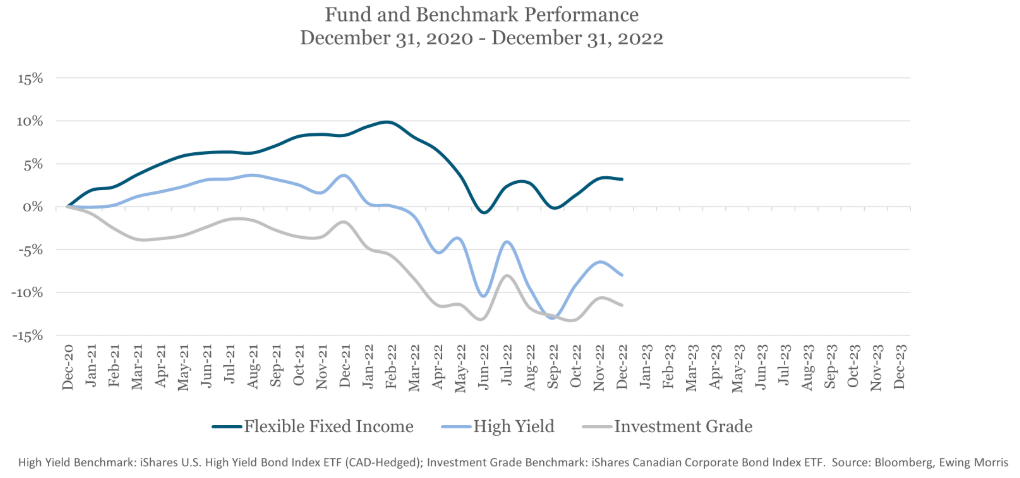

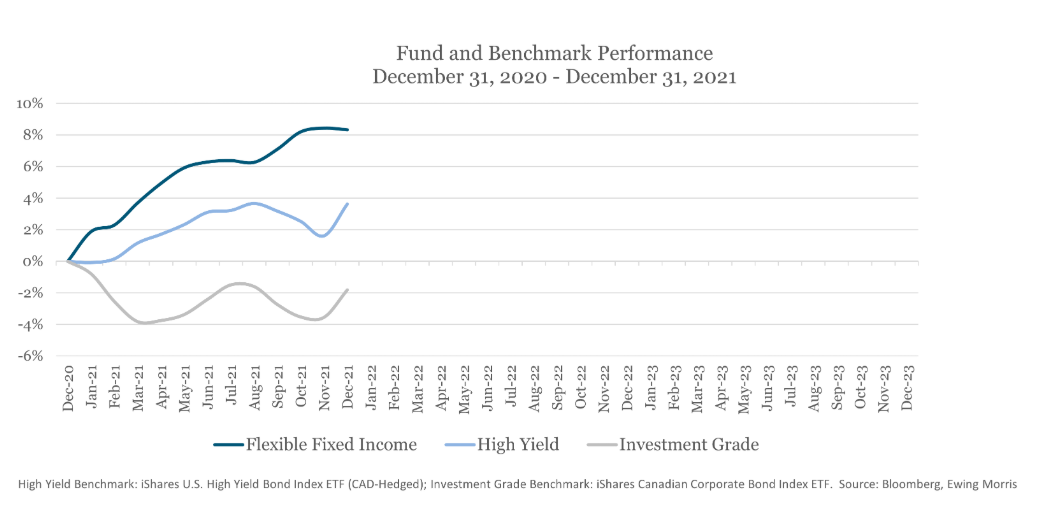

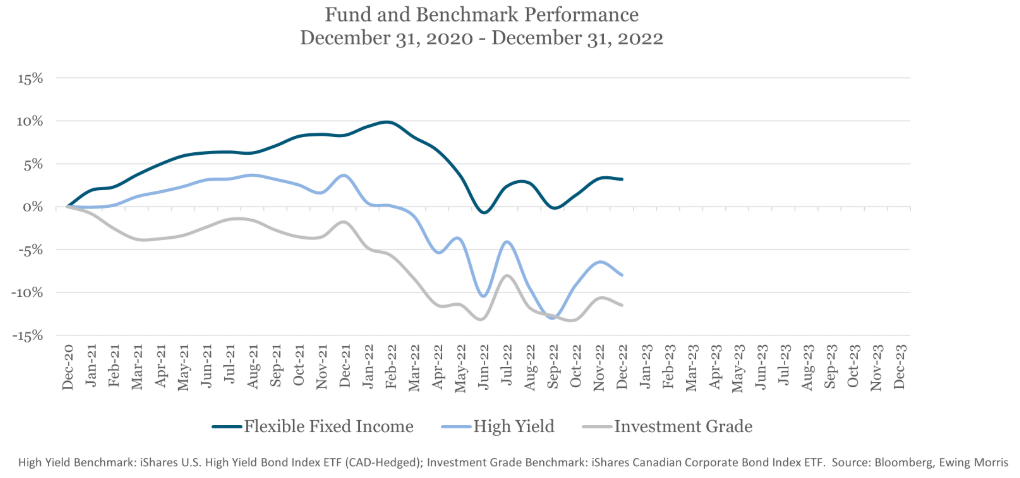

The past three years serve as a more meaningful yardstick for performance evaluation. This is because a variety of market conditions were encountered over this time period.

In 2021, market returns were moderate. 2022 posed the most adverse interest rate conditions in at least a generation. 2023 showcased the most favorable yearly return in high yield since 2016.

These varied conditions underscored something important: the value of a flexible investment mandate; the ability to do something about the opportunities that no one expected to be littered across disparate parts of the market. We have unified these three years into a simple, focused summary. We will start with 2021.

2021

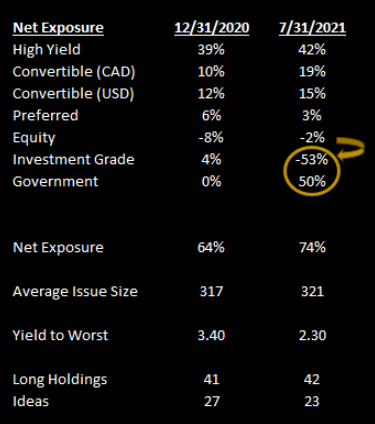

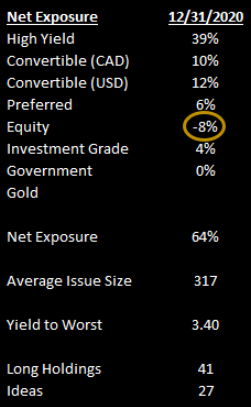

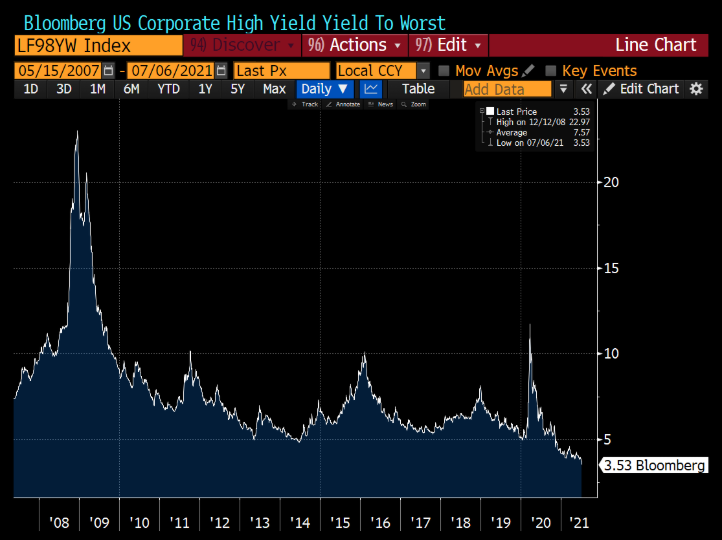

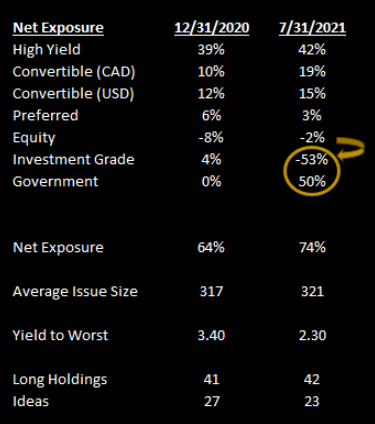

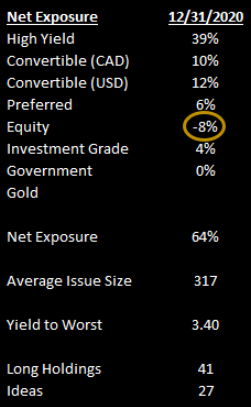

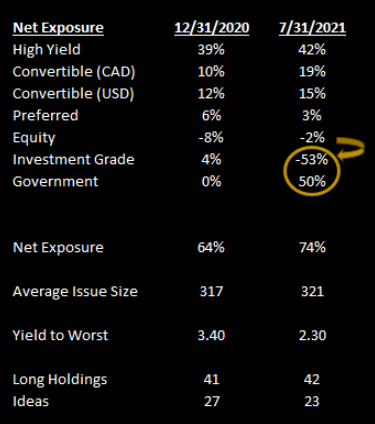

After the staggering rally in 2020, we entered 2021 with a narrowed opportunity set. As a result, the portfolio had near record low net exposure. We also maintained modest equity hedges against certain convertible bond positions, which also reduced the overall risk of the portfolio. We were positioned and ready to act opportunistically. And great investment opportunities did arise. The best example of this was in the days immediately following its takeover announcement, we made swift, significant and attractively-priced purchases of Shaw Communication's Preferred Shares.

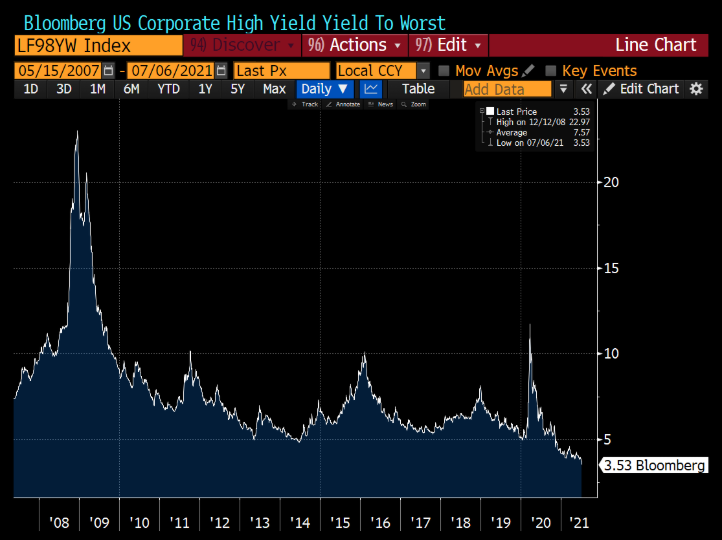

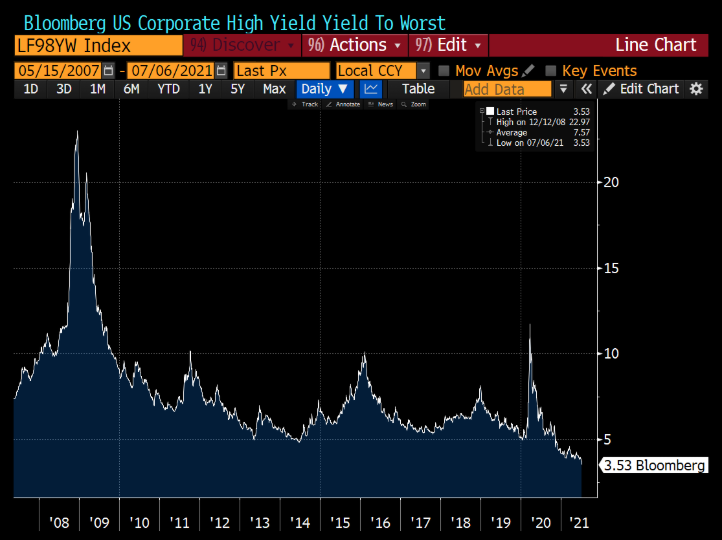

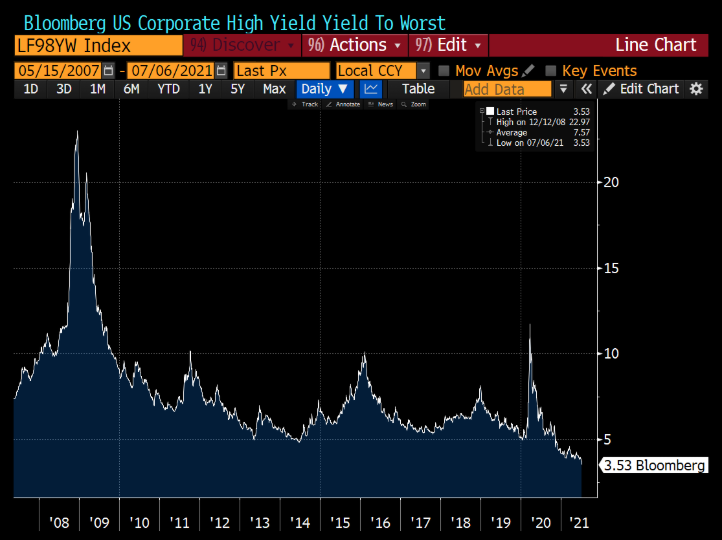

At the beginning of the year, no strategist expected high yield bond prices to rally to a level where the average bond would yield 3.5%. But by the end of July, it did.

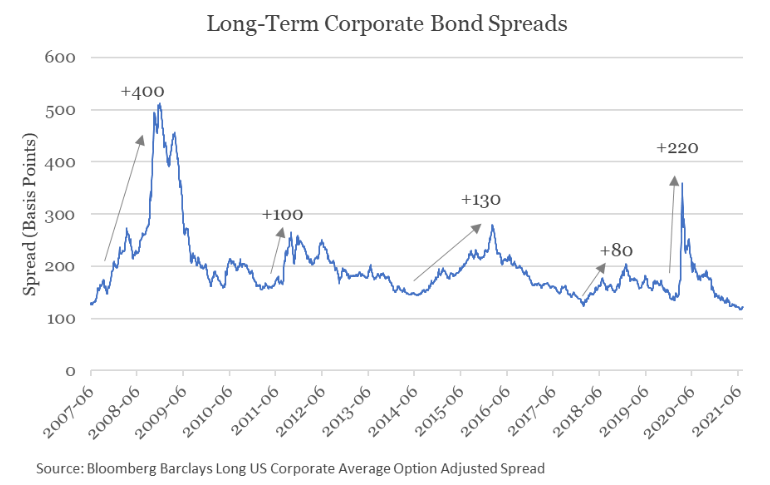

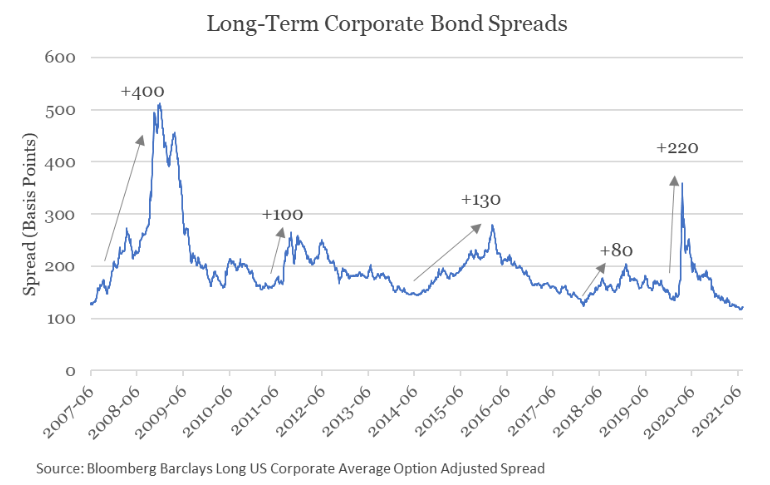

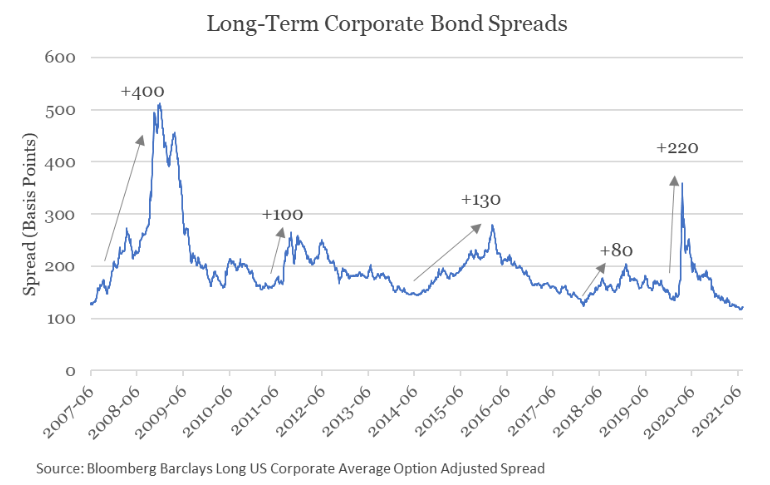

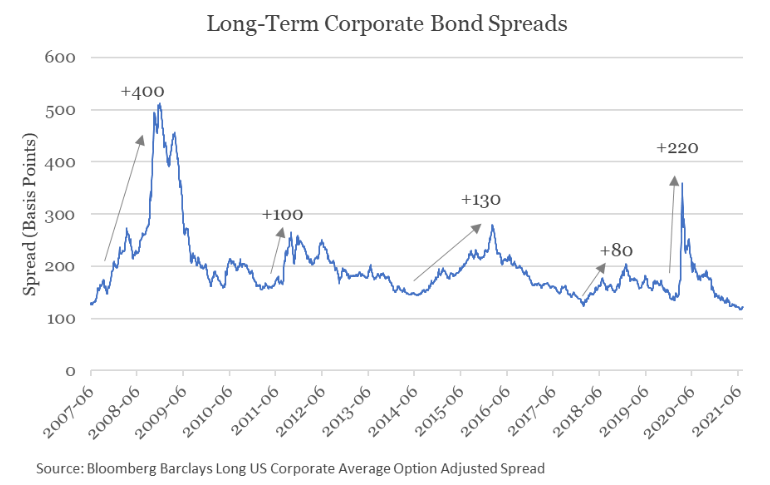

At the beginning of the year, no strategist expected long-term investment grade credit to reach pre-2008 levels, but it did too.

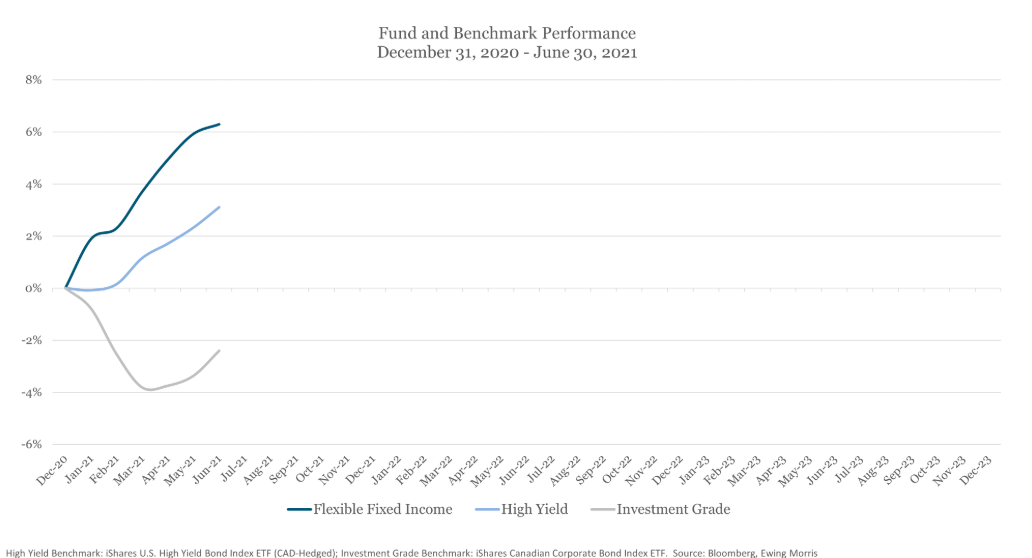

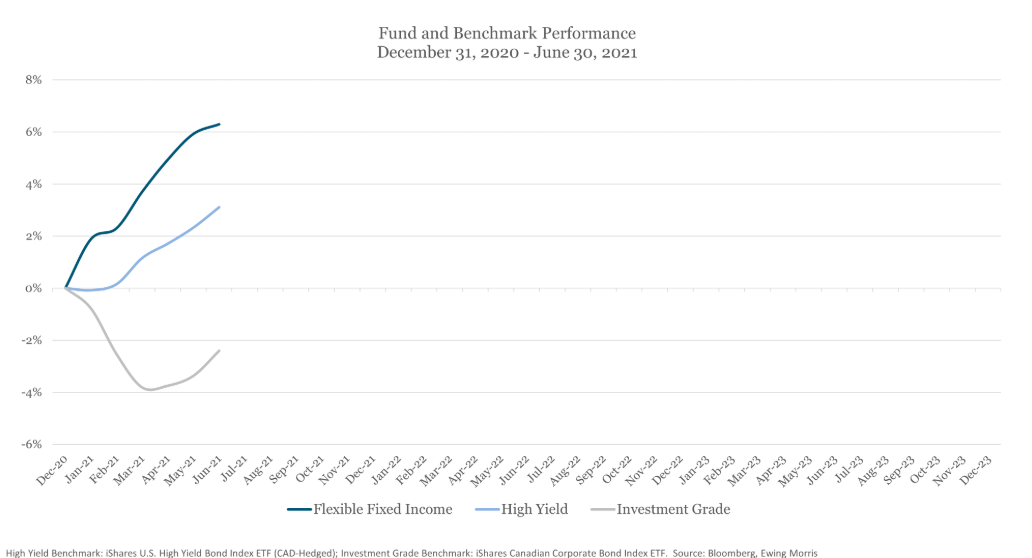

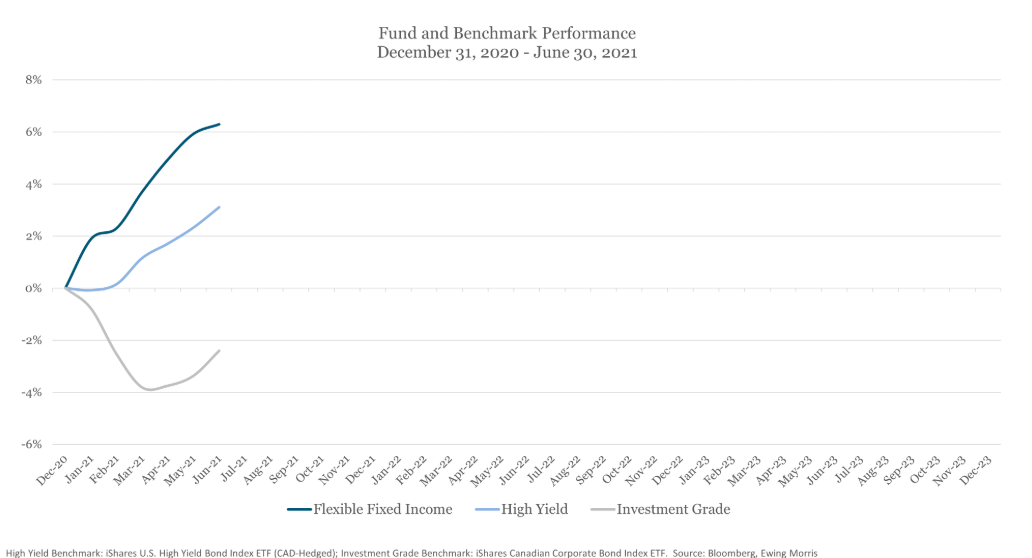

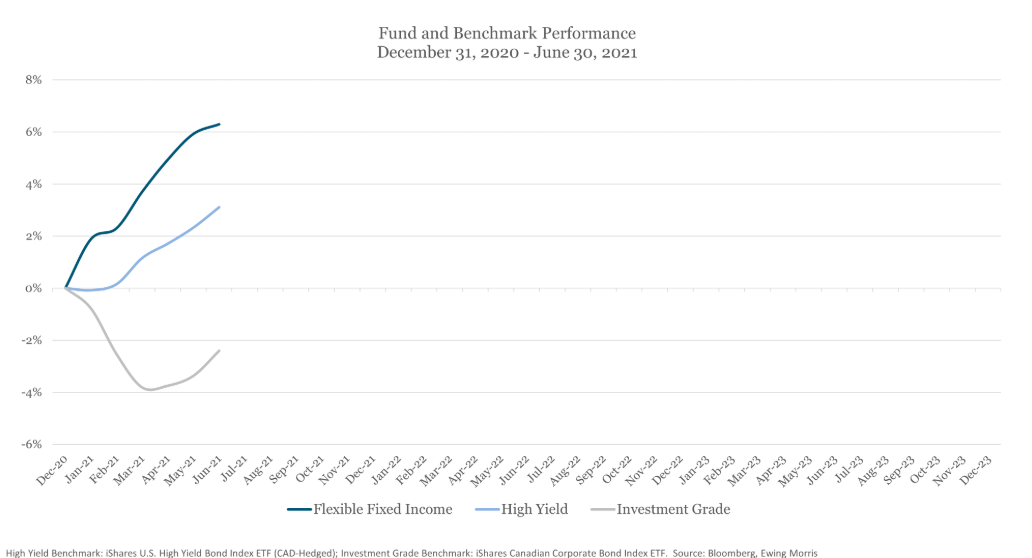

It was a swift start to the year. Through June of 2021, the Fund returned +6.2%.

Since 2020, the Fed-induced liquidity push had managers accepting any price in order to acquire bonds. The COVID-era had broken records: the US Treasury issued bonds due in 2050 at 1.25%. Google issued bonds due in 2060 at 2.25%. Scores of growth companies issued convertible bonds with less than 1% rates of interest. Even a Deli somewhere in New Jersey was worth $2 billion dollars, on paper. The environment was unsustainable. With this extreme backdrop, it was no surprise that we were finding few incremental long opportunities. So, we considered that we might be better served to see what opportunities existed on the short side of the most overbought sectors.

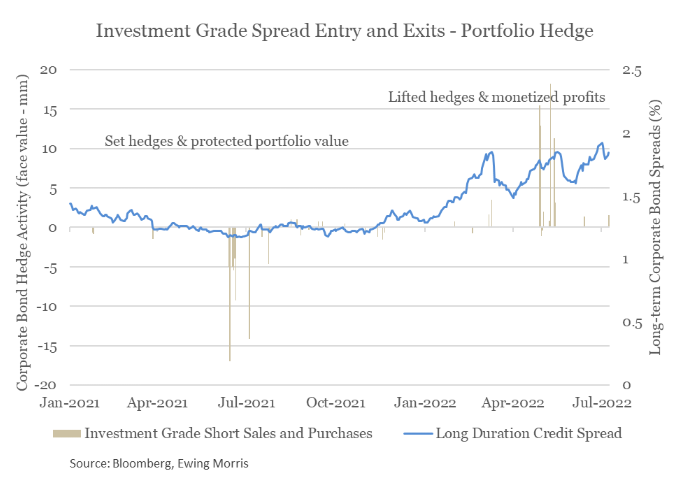

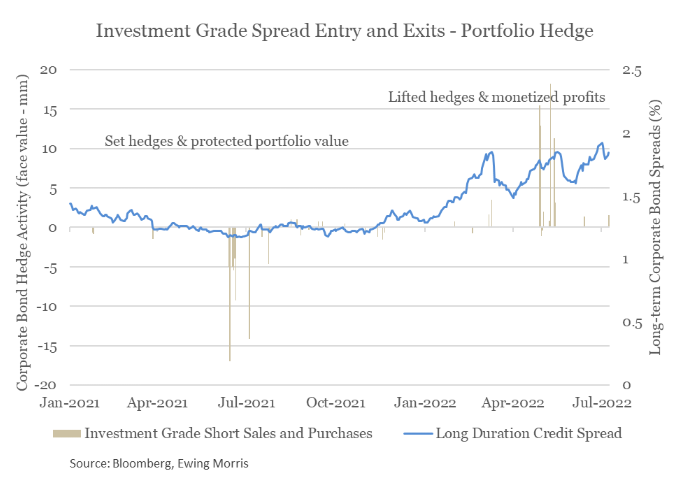

The most distorted prices we could find were in long-term "high quality" credit.

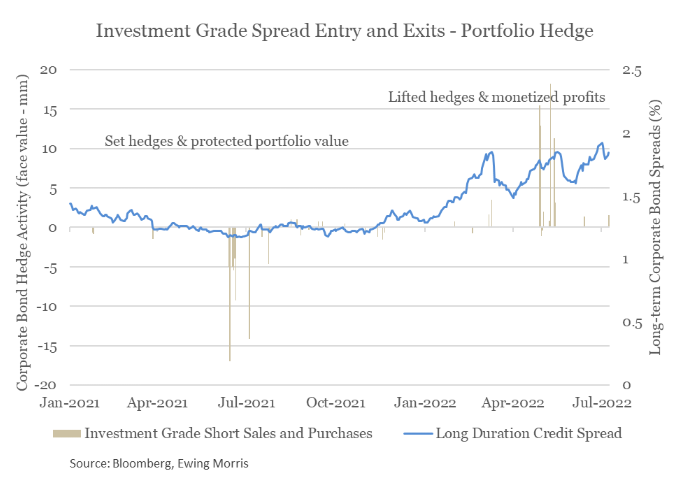

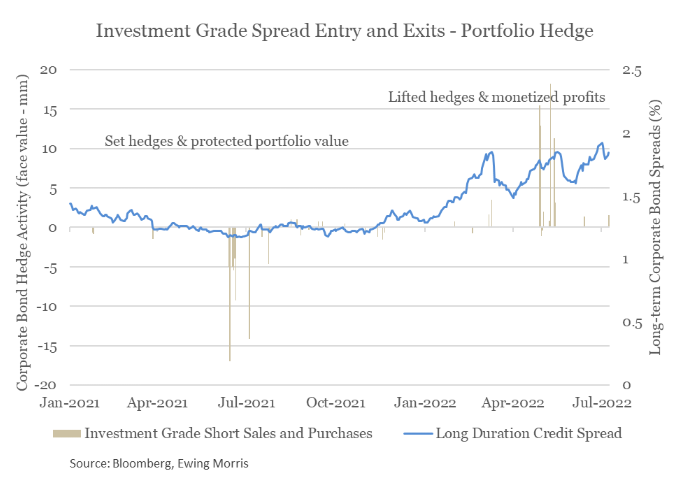

Our assessment was that there was a high probability these credit spreads, given time, could be materially higher due to several factors - debt-fueled M&A activity or inflation being two obvious ones. The investment was to produce a profit if the market’s optimism simply dimmed from its current extreme levels.

On an annual basis, the investment had a very low carrying cost. Since we were shorting a corporate bond and buying the like-maturity government bond, we were only paying the difference between the two (the "credit spread"). The annual total cost to short these credits was in the low to mid 1% range, depending on the bond.

Although we considered many factors, we favored high duration bonds. In some, duration was ~20 years. This meant that if the bond's credit spread increased by only 1 percentage point, it would produce a 20% profit in price for the position. To see a 1 percentage point increase at some point would be unlikely to surprise anyone; a move like this had already happened many times in recent memory.

We concluded that paying out a mid-1% annual premium to get this 20% profit potential was not only an excellent hedge to protect the portfolio, it was a great investment in its own right.

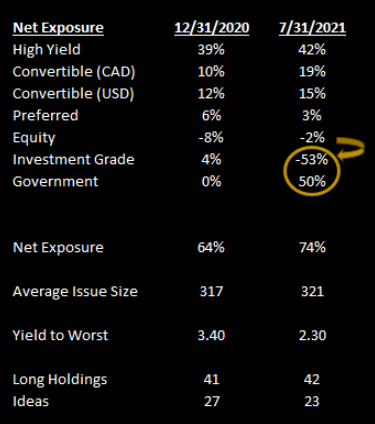

To execute this view, we hand-picked a collection of 38 expensive, long-dated investment grade credits to sell against treasuries via ‘portfolio trades’. The position was exceptionally liquid. It was diversified. It consumed no capital. And it consumed very little margin. For a higher resolution view, please see our Q2 2021 LP Letter.

In the second half of the year, markets softened as the omicron variant proliferated. Contributions from security selection among long positions, and early gains from our investment grade credit hedge provided stable returns through this time.

And by year-end 2021, the Fund produced a net return of +8.3%.

2022

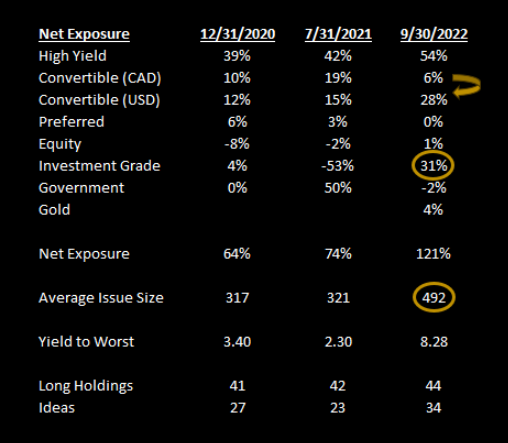

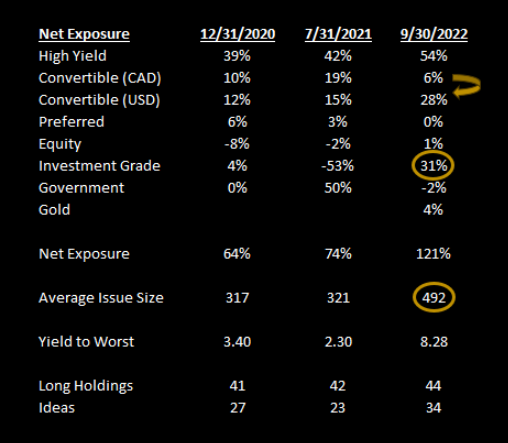

In the spring, the rapid reappraisal of inflation and central bank tightening by interest rate markets caused price declines across all asset classes. With stocks down, it was not a surprise to see credit spreads widening, allowing our portfolio hedge to contribute very well early in the year. By May, the corporate spread hedge had served its purpose and we monetized profits.

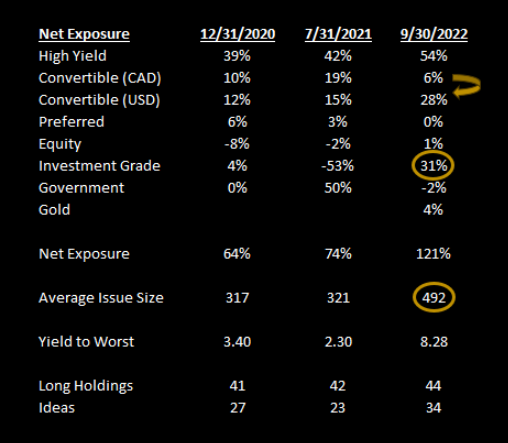

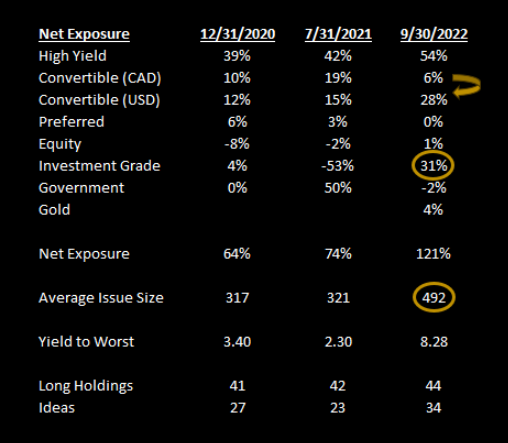

The continued change in interest rates and the price of credit produced a new opportunity set by the fall of 2022, leading to natural changes in the portfolio. Through the year, investment in our own purpose-built technology and systems enhanced our ability to identify event-driven opportunities. At this time, we found many of the most promising opportunities in the investment grade space as underpriced optionality was abundant, due to these bonds’ large discounts to par.

In addition, we reallocated a material portion of our Canadian convertible debentures into more liquid, deeply discounted convertibles in the US, most of which also contained exceptional takeout optionality.

These two changes also combined to increase the average issue size held in the portfolio, positioning us with even more flexibility as we moved through what looked like the unpleasant front edge of a credit cycle.

By the end of 2022, these historic moves in interest rates and rough credit conditions took a devastating toll on almost every facet of the fixed income market. Our hedges in investment grade and favorable bond-picking contributed greatly to results in the year; the Fund produced the strongest year of relative outperformance in its history at +6.5% versus High Yield. Unfortunately, our High Yield and Investment Grade benchmarks were down 11.2% and 9.9%, respectively. And, for the first time measured by a calendar year, the Fund declined in value. For a higher resolution view, including top contributors and unforced errors, please see our 2022 Letter.

In 2022, the Fund declined by 4.5%.

2023

As we moved through 2023, we exited the bulk of our event-driven investment grade bond investments in favor of more attractive US-based convertible bond opportunities.

In the convertible bond market, we were finding many liquid credits with management teams continuing to pivot further to debt-friendly capital allocation and operating policies. In addition to these bonds being well-supported by this fundamental and technical dynamic, technology-focused private equity sponsors continued to circle the space, underpinning the hidden option value in the convertible bond contracts' "Fundamental Change" (change of control) covenant.

We ended 2023 with a defensive posture given our high liquidity, low duration and equity hedges.

In 2023, the Fund returned +10.3%

And that was our past three years together.

Growth in our Capacity

At its most abstract, the foremost pre-requisite for generating great investment results is the capacity to produce commercial insight. If this is true, an investment manager’s focus should, perhaps to the exclusion of almost anything else, be dedicated to the design and implementation of an approach to produce and capitalize on such insight. We published a thoroughly-defined investment philosophy at the Fund’s inception, but beginning in 2021, we finally denied the Tyranny of the Urgent to evolve this area so fundamental to our work. Since this time, we have invested time redesigning, rebuilding and then refining our systems “stack” more than in all prior years combined. Our ongoing iteration and implementation continues to this day.

Combined, these systems have enhanced how and where we gather data, how we convert this data into information and commercial insight and how and where we engage in the market.

Our differentiated returns over the past three years are a testament to this new convergence of technology and judgement. In addition, groundbreaking advances in software copiloting models have also enabled us to seamlessly iterate.

The most exciting area of our work is in finding new ideas. We have deployed several, internally-developed systems to this end, which provide diversified on-ramps for idea generation. These systems increase our ability to consistently find what we call “high-potential anomalies” - situations worth investigating.

By way of a yard-sale metaphor, we've now got a high-resolution drone that, on any given Sunday, can help us spot the Patek Nautilus or Group of Seven amongst Rick's old VHS tapes, bowling trophies and mannequin heads.

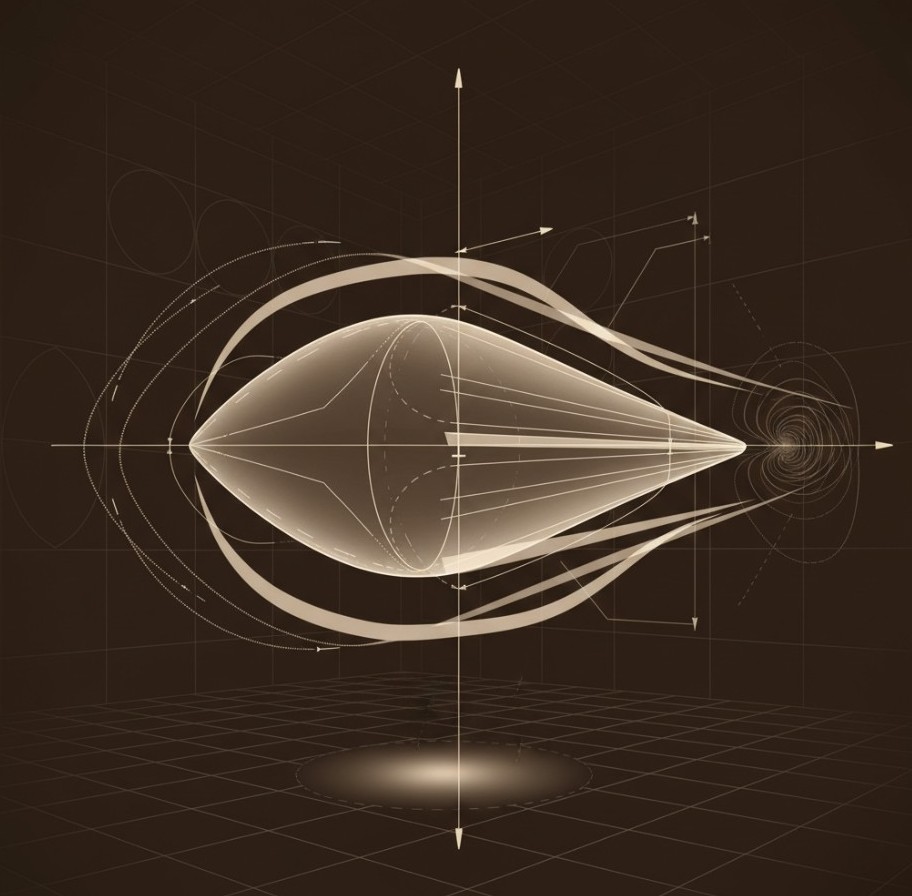

Our favorite product that we have developed is our X-Ray tool, which allows us to perform 'deep scoping' work on prospective investments. The analytics span a variety of user-defined dimensions such as security valuation and corporate governance. It also includes a risk/reward landscape, expressed in 3-D space. Bloomberg, Capital IQ, Factset all do not have this functionality in fixed income, so we built it ourselves. Now we are finding these anomalies in a fraction of the time it took previously. At its core, we are tapping into more and higher quality ‘looks’ at what’s out there. This resource not only helps us compound our pattern recognition but it also allows us to raise our bar for what constitutes a great investment. We are heartened to know there’s lots of tread left on the tires of this new technology and we are leaning into this with all we have.

Outlook

It is hard to predict the weather of tomorrow, but it can be instructive looking out the window to see what’s actually here. What we are seeing is overall financial conditions that are fairly tight. We are seeing bankruptcies on the rise. And interest rate markets tell us we are on the eve a cutting cycle across multiple central banks. These factors do not obviously point to - at least initially - a rosy outlook for risk markets.

But our response to this is the same as it always has been: own bonds at valuations that should compensate us well even in the event a difficult environment comes to pass, and find hedges with positive expected value.

Perhaps most important is that the hand of interest rates has shaken the snow globe mightily for the last two years and today, we see a market of bonds containing plenty of situation-specific opportunities. The portfolio yields in the 7 percent range, has strong capital appreciation potential and we are thoroughly constructive on our ability to enhance your investment’s value in 2024. In a world where investors expect 10% from equities, we are not alone in our view that the high yield space is a very competitive alternative to equities at this point in the cycle. When we add to this possible positive surprises in the portfolio due to corporate actions, we can’t help but to look forward to the year ahead.

Thank you for your continued confidence.

To the Limited Partners of the Ewing Morris Flexible Fixed Income Fund:

If 2023 had a theme, Growth was it. In 2023, we grew your capital. Our capacity to create value in credit also grew. But these are just words on a page. Let's explore the facts on the ground.

Growing Your Capital in 2023

Growth of your invested capital is our foremost concern. To this end, 2023 was a successful year as the Fund returned +10.3%.*

*All Fund returns referenced reflect Class P returns, net of all fees and expenses.

On a relative basis, the Fund outpaced its High Yield and Investment Grade benchmarks for the majority of the year. As the year finished, Fund returns were overtaken by the High Yield benchmark, as all asset classes staged a pronounced rally following the dovish Federal Reserve meeting in early November.

2023 was not a year where a cautious approach was rewarded. It was a year where corporate bonds that had more risk of any kind - credit or interest rate - performed the best. Although exposures varied through the year, on average, the Fund was positioned with less credit and interest rate risk than the high yield and investment grade benchmarks, respectively.

From a credit perspective, the portfolio held no CCC exposure and carried equity hedges for the majority the year. Both of these attributes positioned the fund to preserve capital in the event of a hard landing.

From an interest rate risk perspective, the fund had substantially lower duration than the investment grade market and averaged lower duration than the high yield market in the year.

In spite of its more conservative positioning, the Fund outperformed its investment grade benchmark for the full year and largely kept pace with its high yield benchmark. This performance was principally due to strong security selection, our core discipline. We had no meaningful mishaps in the year and for the first time, on an outright basis, we allocated capital to the "highest quality" asset class: US Treasuries. The price paid: ~44 cents on the dollar. This was an astonishing reminder that what drives a AAA investment outcome is not a bond's rating. It's a bond's price.

Looking Back

The past three years serve as a more meaningful yardstick for performance evaluation. This is because a variety of market conditions were encountered over this time period.

In 2021, market returns were moderate. 2022 posed the most adverse interest rate conditions in at least a generation. 2023 showcased the most favorable yearly return in high yield since 2016.

These varied conditions underscored something important: the value of a flexible investment mandate; the ability to do something about the opportunities that no one expected to be littered across disparate parts of the market. We have unified these three years into a simple, focused summary. We will start with 2021.

2021

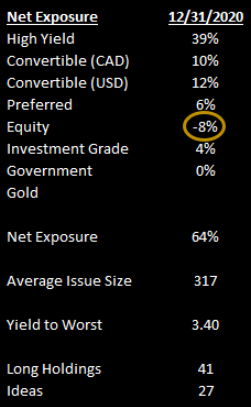

After the staggering rally in 2020, we entered 2021 with a narrowed opportunity set. As a result, the portfolio had near record low net exposure. We also maintained modest equity hedges against certain convertible bond positions, which also reduced the overall risk of the portfolio. We were positioned and ready to act opportunistically. And great investment opportunities did arise. The best example of this was in the days immediately following its takeover announcement, we made swift, significant and attractively-priced purchases of Shaw Communication's Preferred Shares.

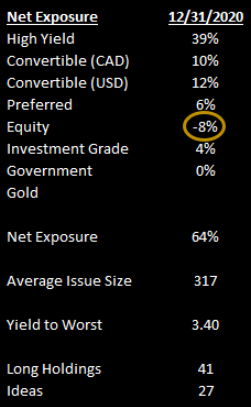

At the beginning of the year, no strategist expected high yield bond prices to rally to a level where the average bond would yield 3.5%. But by the end of July, it did.

At the beginning of the year, no strategist expected long-term investment grade credit to reach pre-2008 levels, but it did too.

It was a swift start to the year. Through June of 2021, the Fund returned +6.2%.

Since 2020, the Fed-induced liquidity push had managers accepting any price in order to acquire bonds. The COVID-era had broken records: the US Treasury issued bonds due in 2050 at 1.25%. Google issued bonds due in 2060 at 2.25%. Scores of growth companies issued convertible bonds with less than 1% rates of interest. Even a Deli somewhere in New Jersey was worth $2 billion dollars, on paper. The environment was unsustainable. With this extreme backdrop, it was no surprise that we were finding few incremental long opportunities. So, we considered that we might be better served to see what opportunities existed on the short side of the most overbought sectors.

The most distorted prices we could find were in long-term "high quality" credit.

Our assessment was that there was a high probability these credit spreads, given time, could be materially higher due to several factors - debt-fueled M&A activity or inflation being two obvious ones. The investment was to produce a profit if the market’s optimism simply dimmed from its current extreme levels.

On an annual basis, the investment had a very low carrying cost. Since we were shorting a corporate bond and buying the like-maturity government bond, we were only paying the difference between the two (the "credit spread"). The annual total cost to short these credits was in the low to mid 1% range, depending on the bond.

Although we considered many factors, we favored high duration bonds. In some, duration was ~20 years. This meant that if the bond's credit spread increased by only 1 percentage point, it would produce a 20% profit in price for the position. To see a 1 percentage point increase at some point would be unlikely to surprise anyone; a move like this had already happened many times in recent memory.

We concluded that paying out a mid-1% annual premium to get this 20% profit potential was not only an excellent hedge to protect the portfolio, it was a great investment in its own right.

To execute this view, we hand-picked a collection of 38 expensive, long-dated investment grade credits to sell against treasuries via ‘portfolio trades’. The position was exceptionally liquid. It was diversified. It consumed no capital. And it consumed very little margin. For a higher resolution view, please see our Q2 2021 LP Letter.

In the second half of the year, markets softened as the omicron variant proliferated. Contributions from security selection among long positions, and early gains from our investment grade credit hedge provided stable returns through this time.

And by year-end 2021, the Fund produced a net return of +8.3%.

2022

In the spring, the rapid reappraisal of inflation and central bank tightening by interest rate markets caused price declines across all asset classes. With stocks down, it was not a surprise to see credit spreads widening, allowing our portfolio hedge to contribute very well early in the year. By May, the corporate spread hedge had served its purpose and we monetized profits.

The continued change in interest rates and the price of credit produced a new opportunity set by the fall of 2022, leading to natural changes in the portfolio. Through the year, investment in our own purpose-built technology and systems enhanced our ability to identify event-driven opportunities. At this time, we found many of the most promising opportunities in the investment grade space as underpriced optionality was abundant, due to these bonds’ large discounts to par.

In addition, we reallocated a material portion of our Canadian convertible debentures into more liquid, deeply discounted convertibles in the US, most of which also contained exceptional takeout optionality.

These two changes also combined to increase the average issue size held in the portfolio, positioning us with even more flexibility as we moved through what looked like the unpleasant front edge of a credit cycle.

By the end of 2022, these historic moves in interest rates and rough credit conditions took a devastating toll on almost every facet of the fixed income market. Our hedges in investment grade and favorable bond-picking contributed greatly to results in the year; the Fund produced the strongest year of relative outperformance in its history at +6.5% versus High Yield. Unfortunately, our High Yield and Investment Grade benchmarks were down 11.2% and 9.9%, respectively. And, for the first time measured by a calendar year, the Fund declined in value. For a higher resolution view, including top contributors and unforced errors, please see our 2022 Letter.

In 2022, the Fund declined by 4.5%.

2023

As we moved through 2023, we exited the bulk of our event-driven investment grade bond investments in favor of more attractive US-based convertible bond opportunities.

In the convertible bond market, we were finding many liquid credits with management teams continuing to pivot further to debt-friendly capital allocation and operating policies. In addition to these bonds being well-supported by this fundamental and technical dynamic, technology-focused private equity sponsors continued to circle the space, underpinning the hidden option value in the convertible bond contracts' "Fundamental Change" (change of control) covenant.

We ended 2023 with a defensive posture given our high liquidity, low duration and equity hedges.

In 2023, the Fund returned +10.3%

And that was our past three years together.

Growth in our Capacity

At its most abstract, the foremost pre-requisite for generating great investment results is the capacity to produce commercial insight. If this is true, an investment manager’s focus should, perhaps to the exclusion of almost anything else, be dedicated to the design and implementation of an approach to produce and capitalize on such insight. We published a thoroughly-defined investment philosophy at the Fund’s inception, but beginning in 2021, we finally denied the Tyranny of the Urgent to evolve this area so fundamental to our work. Since this time, we have invested time redesigning, rebuilding and then refining our systems “stack” more than in all prior years combined. Our ongoing iteration and implementation continues to this day.

Combined, these systems have enhanced how and where we gather data, how we convert this data into information and commercial insight and how and where we engage in the market.

Our differentiated returns over the past three years are a testament to this new convergence of technology and judgement. In addition, groundbreaking advances in software copiloting models have also enabled us to seamlessly iterate.

The most exciting area of our work is in finding new ideas. We have deployed several, internally-developed systems to this end, which provide diversified on-ramps for idea generation. These systems increase our ability to consistently find what we call “high-potential anomalies” - situations worth investigating.

By way of a yard-sale metaphor, we've now got a high-resolution drone that, on any given Sunday, can help us spot the Patek Nautilus or Group of Seven amongst Rick's old VHS tapes, bowling trophies and mannequin heads.

Our favorite product that we have developed is our X-Ray tool, which allows us to perform 'deep scoping' work on prospective investments. The analytics span a variety of user-defined dimensions such as security valuation and corporate governance. It also includes a risk/reward landscape, expressed in 3-D space. Bloomberg, Capital IQ, Factset all do not have this functionality in fixed income, so we built it ourselves. Now we are finding these anomalies in a fraction of the time it took previously. At its core, we are tapping into more and higher quality ‘looks’ at what’s out there. This resource not only helps us compound our pattern recognition but it also allows us to raise our bar for what constitutes a great investment. We are heartened to know there’s lots of tread left on the tires of this new technology and we are leaning into this with all we have.

Outlook

It is hard to predict the weather of tomorrow, but it can be instructive looking out the window to see what’s actually here. What we are seeing is overall financial conditions that are fairly tight. We are seeing bankruptcies on the rise. And interest rate markets tell us we are on the eve a cutting cycle across multiple central banks. These factors do not obviously point to - at least initially - a rosy outlook for risk markets.

But our response to this is the same as it always has been: own bonds at valuations that should compensate us well even in the event a difficult environment comes to pass, and find hedges with positive expected value.

Perhaps most important is that the hand of interest rates has shaken the snow globe mightily for the last two years and today, we see a market of bonds containing plenty of situation-specific opportunities. The portfolio yields in the 7 percent range, has strong capital appreciation potential and we are thoroughly constructive on our ability to enhance your investment’s value in 2024. In a world where investors expect 10% from equities, we are not alone in our view that the high yield space is a very competitive alternative to equities at this point in the cycle. When we add to this possible positive surprises in the portfolio due to corporate actions, we can’t help but to look forward to the year ahead.

Thank you for your continued confidence.

To the Limited Partners of the Ewing Morris Flexible Fixed Income Fund:

If 2023 had a theme, Growth was it. In 2023, we grew your capital. Our capacity to create value in credit also grew. But these are just words on a page. Let's explore the facts on the ground.

Growing Your Capital in 2023

Growth of your invested capital is our foremost concern. To this end, 2023 was a successful year as the Fund returned +10.3%.*

*All Fund returns referenced reflect Class P returns, net of all fees and expenses.

On a relative basis, the Fund outpaced its High Yield and Investment Grade benchmarks for the majority of the year. As the year finished, Fund returns were overtaken by the High Yield benchmark, as all asset classes staged a pronounced rally following the dovish Federal Reserve meeting in early November.

2023 was not a year where a cautious approach was rewarded. It was a year where corporate bonds that had more risk of any kind - credit or interest rate - performed the best. Although exposures varied through the year, on average, the Fund was positioned with less credit and interest rate risk than the high yield and investment grade benchmarks, respectively.

From a credit perspective, the portfolio held no CCC exposure and carried equity hedges for the majority the year. Both of these attributes positioned the fund to preserve capital in the event of a hard landing.

From an interest rate risk perspective, the fund had substantially lower duration than the investment grade market and averaged lower duration than the high yield market in the year.

In spite of its more conservative positioning, the Fund outperformed its investment grade benchmark for the full year and largely kept pace with its high yield benchmark. This performance was principally due to strong security selection, our core discipline. We had no meaningful mishaps in the year and for the first time, on an outright basis, we allocated capital to the "highest quality" asset class: US Treasuries. The price paid: ~44 cents on the dollar. This was an astonishing reminder that what drives a AAA investment outcome is not a bond's rating. It's a bond's price.

Looking Back

The past three years serve as a more meaningful yardstick for performance evaluation. This is because a variety of market conditions were encountered over this time period.

In 2021, market returns were moderate. 2022 posed the most adverse interest rate conditions in at least a generation. 2023 showcased the most favorable yearly return in high yield since 2016.

These varied conditions underscored something important: the value of a flexible investment mandate; the ability to do something about the opportunities that no one expected to be littered across disparate parts of the market. We have unified these three years into a simple, focused summary. We will start with 2021.

2021

After the staggering rally in 2020, we entered 2021 with a narrowed opportunity set. As a result, the portfolio had near record low net exposure. We also maintained modest equity hedges against certain convertible bond positions, which also reduced the overall risk of the portfolio. We were positioned and ready to act opportunistically. And great investment opportunities did arise. The best example of this was in the days immediately following its takeover announcement, we made swift, significant and attractively-priced purchases of Shaw Communication's Preferred Shares.

At the beginning of the year, no strategist expected high yield bond prices to rally to a level where the average bond would yield 3.5%. But by the end of July, it did.

At the beginning of the year, no strategist expected long-term investment grade credit to reach pre-2008 levels, but it did too.

It was a swift start to the year. Through June of 2021, the Fund returned +6.2%.

Since 2020, the Fed-induced liquidity push had managers accepting any price in order to acquire bonds. The COVID-era had broken records: the US Treasury issued bonds due in 2050 at 1.25%. Google issued bonds due in 2060 at 2.25%. Scores of growth companies issued convertible bonds with less than 1% rates of interest. Even a Deli somewhere in New Jersey was worth $2 billion dollars, on paper. The environment was unsustainable. With this extreme backdrop, it was no surprise that we were finding few incremental long opportunities. So, we considered that we might be better served to see what opportunities existed on the short side of the most overbought sectors.

The most distorted prices we could find were in long-term "high quality" credit.

Our assessment was that there was a high probability these credit spreads, given time, could be materially higher due to several factors - debt-fueled M&A activity or inflation being two obvious ones. The investment was to produce a profit if the market’s optimism simply dimmed from its current extreme levels.

On an annual basis, the investment had a very low carrying cost. Since we were shorting a corporate bond and buying the like-maturity government bond, we were only paying the difference between the two (the "credit spread"). The annual total cost to short these credits was in the low to mid 1% range, depending on the bond.

Although we considered many factors, we favored high duration bonds. In some, duration was ~20 years. This meant that if the bond's credit spread increased by only 1 percentage point, it would produce a 20% profit in price for the position. To see a 1 percentage point increase at some point would be unlikely to surprise anyone; a move like this had already happened many times in recent memory.

We concluded that paying out a mid-1% annual premium to get this 20% profit potential was not only an excellent hedge to protect the portfolio, it was a great investment in its own right.

To execute this view, we hand-picked a collection of 38 expensive, long-dated investment grade credits to sell against treasuries via ‘portfolio trades’. The position was exceptionally liquid. It was diversified. It consumed no capital. And it consumed very little margin. For a higher resolution view, please see our Q2 2021 LP Letter.

In the second half of the year, markets softened as the omicron variant proliferated. Contributions from security selection among long positions, and early gains from our investment grade credit hedge provided stable returns through this time.

And by year-end 2021, the Fund produced a net return of +8.3%.

2022

In the spring, the rapid reappraisal of inflation and central bank tightening by interest rate markets caused price declines across all asset classes. With stocks down, it was not a surprise to see credit spreads widening, allowing our portfolio hedge to contribute very well early in the year. By May, the corporate spread hedge had served its purpose and we monetized profits.

The continued change in interest rates and the price of credit produced a new opportunity set by the fall of 2022, leading to natural changes in the portfolio. Through the year, investment in our own purpose-built technology and systems enhanced our ability to identify event-driven opportunities. At this time, we found many of the most promising opportunities in the investment grade space as underpriced optionality was abundant, due to these bonds’ large discounts to par.

In addition, we reallocated a material portion of our Canadian convertible debentures into more liquid, deeply discounted convertibles in the US, most of which also contained exceptional takeout optionality.

These two changes also combined to increase the average issue size held in the portfolio, positioning us with even more flexibility as we moved through what looked like the unpleasant front edge of a credit cycle.

By the end of 2022, these historic moves in interest rates and rough credit conditions took a devastating toll on almost every facet of the fixed income market. Our hedges in investment grade and favorable bond-picking contributed greatly to results in the year; the Fund produced the strongest year of relative outperformance in its history at +6.5% versus High Yield. Unfortunately, our High Yield and Investment Grade benchmarks were down 11.2% and 9.9%, respectively. And, for the first time measured by a calendar year, the Fund declined in value. For a higher resolution view, including top contributors and unforced errors, please see our 2022 Letter.

In 2022, the Fund declined by 4.5%.

2023

As we moved through 2023, we exited the bulk of our event-driven investment grade bond investments in favor of more attractive US-based convertible bond opportunities.

In the convertible bond market, we were finding many liquid credits with management teams continuing to pivot further to debt-friendly capital allocation and operating policies. In addition to these bonds being well-supported by this fundamental and technical dynamic, technology-focused private equity sponsors continued to circle the space, underpinning the hidden option value in the convertible bond contracts' "Fundamental Change" (change of control) covenant.

We ended 2023 with a defensive posture given our high liquidity, low duration and equity hedges.

In 2023, the Fund returned +10.3%

And that was our past three years together.

Growth in our Capacity

At its most abstract, the foremost pre-requisite for generating great investment results is the capacity to produce commercial insight. If this is true, an investment manager’s focus should, perhaps to the exclusion of almost anything else, be dedicated to the design and implementation of an approach to produce and capitalize on such insight. We published a thoroughly-defined investment philosophy at the Fund’s inception, but beginning in 2021, we finally denied the Tyranny of the Urgent to evolve this area so fundamental to our work. Since this time, we have invested time redesigning, rebuilding and then refining our systems “stack” more than in all prior years combined. Our ongoing iteration and implementation continues to this day.

Combined, these systems have enhanced how and where we gather data, how we convert this data into information and commercial insight and how and where we engage in the market.

Our differentiated returns over the past three years are a testament to this new convergence of technology and judgement. In addition, groundbreaking advances in software copiloting models have also enabled us to seamlessly iterate.

The most exciting area of our work is in finding new ideas. We have deployed several, internally-developed systems to this end, which provide diversified on-ramps for idea generation. These systems increase our ability to consistently find what we call “high-potential anomalies” - situations worth investigating.

By way of a yard-sale metaphor, we've now got a high-resolution drone that, on any given Sunday, can help us spot the Patek Nautilus or Group of Seven amongst Rick's old VHS tapes, bowling trophies and mannequin heads.

Our favorite product that we have developed is our X-Ray tool, which allows us to perform 'deep scoping' work on prospective investments. The analytics span a variety of user-defined dimensions such as security valuation and corporate governance. It also includes a risk/reward landscape, expressed in 3-D space. Bloomberg, Capital IQ, Factset all do not have this functionality in fixed income, so we built it ourselves. Now we are finding these anomalies in a fraction of the time it took previously. At its core, we are tapping into more and higher quality ‘looks’ at what’s out there. This resource not only helps us compound our pattern recognition but it also allows us to raise our bar for what constitutes a great investment. We are heartened to know there’s lots of tread left on the tires of this new technology and we are leaning into this with all we have.

Outlook

It is hard to predict the weather of tomorrow, but it can be instructive looking out the window to see what’s actually here. What we are seeing is overall financial conditions that are fairly tight. We are seeing bankruptcies on the rise. And interest rate markets tell us we are on the eve a cutting cycle across multiple central banks. These factors do not obviously point to - at least initially - a rosy outlook for risk markets.

But our response to this is the same as it always has been: own bonds at valuations that should compensate us well even in the event a difficult environment comes to pass, and find hedges with positive expected value.

Perhaps most important is that the hand of interest rates has shaken the snow globe mightily for the last two years and today, we see a market of bonds containing plenty of situation-specific opportunities. The portfolio yields in the 7 percent range, has strong capital appreciation potential and we are thoroughly constructive on our ability to enhance your investment’s value in 2024. In a world where investors expect 10% from equities, we are not alone in our view that the high yield space is a very competitive alternative to equities at this point in the cycle. When we add to this possible positive surprises in the portfolio due to corporate actions, we can’t help but to look forward to the year ahead.

Thank you for your continued confidence.

To the Limited Partners of the Ewing Morris Flexible Fixed Income Fund:

If 2023 had a theme, Growth was it. In 2023, we grew your capital. Our capacity to create value in credit also grew. But these are just words on a page. Let's explore the facts on the ground.

Growing Your Capital in 2023

Growth of your invested capital is our foremost concern. To this end, 2023 was a successful year as the Fund returned +10.3%.*

*All Fund returns referenced reflect Class P returns, net of all fees and expenses.

On a relative basis, the Fund outpaced its High Yield and Investment Grade benchmarks for the majority of the year. As the year finished, Fund returns were overtaken by the High Yield benchmark, as all asset classes staged a pronounced rally following the dovish Federal Reserve meeting in early November.

2023 was not a year where a cautious approach was rewarded. It was a year where corporate bonds that had more risk of any kind - credit or interest rate - performed the best. Although exposures varied through the year, on average, the Fund was positioned with less credit and interest rate risk than the high yield and investment grade benchmarks, respectively.

From a credit perspective, the portfolio held no CCC exposure and carried equity hedges for the majority the year. Both of these attributes positioned the fund to preserve capital in the event of a hard landing.

From an interest rate risk perspective, the fund had substantially lower duration than the investment grade market and averaged lower duration than the high yield market in the year.

In spite of its more conservative positioning, the Fund outperformed its investment grade benchmark for the full year and largely kept pace with its high yield benchmark. This performance was principally due to strong security selection, our core discipline. We had no meaningful mishaps in the year and for the first time, on an outright basis, we allocated capital to the "highest quality" asset class: US Treasuries. The price paid: ~44 cents on the dollar. This was an astonishing reminder that what drives a AAA investment outcome is not a bond's rating. It's a bond's price.

Looking Back

The past three years serve as a more meaningful yardstick for performance evaluation. This is because a variety of market conditions were encountered over this time period.

In 2021, market returns were moderate. 2022 posed the most adverse interest rate conditions in at least a generation. 2023 showcased the most favorable yearly return in high yield since 2016.

These varied conditions underscored something important: the value of a flexible investment mandate; the ability to do something about the opportunities that no one expected to be littered across disparate parts of the market. We have unified these three years into a simple, focused summary. We will start with 2021.

2021

After the staggering rally in 2020, we entered 2021 with a narrowed opportunity set. As a result, the portfolio had near record low net exposure. We also maintained modest equity hedges against certain convertible bond positions, which also reduced the overall risk of the portfolio. We were positioned and ready to act opportunistically. And great investment opportunities did arise. The best example of this was in the days immediately following its takeover announcement, we made swift, significant and attractively-priced purchases of Shaw Communication's Preferred Shares.

At the beginning of the year, no strategist expected high yield bond prices to rally to a level where the average bond would yield 3.5%. But by the end of July, it did.

At the beginning of the year, no strategist expected long-term investment grade credit to reach pre-2008 levels, but it did too.

It was a swift start to the year. Through June of 2021, the Fund returned +6.2%.

Since 2020, the Fed-induced liquidity push had managers accepting any price in order to acquire bonds. The COVID-era had broken records: the US Treasury issued bonds due in 2050 at 1.25%. Google issued bonds due in 2060 at 2.25%. Scores of growth companies issued convertible bonds with less than 1% rates of interest. Even a Deli somewhere in New Jersey was worth $2 billion dollars, on paper. The environment was unsustainable. With this extreme backdrop, it was no surprise that we were finding few incremental long opportunities. So, we considered that we might be better served to see what opportunities existed on the short side of the most overbought sectors.

The most distorted prices we could find were in long-term "high quality" credit.

Our assessment was that there was a high probability these credit spreads, given time, could be materially higher due to several factors - debt-fueled M&A activity or inflation being two obvious ones. The investment was to produce a profit if the market’s optimism simply dimmed from its current extreme levels.

On an annual basis, the investment had a very low carrying cost. Since we were shorting a corporate bond and buying the like-maturity government bond, we were only paying the difference between the two (the "credit spread"). The annual total cost to short these credits was in the low to mid 1% range, depending on the bond.

Although we considered many factors, we favored high duration bonds. In some, duration was ~20 years. This meant that if the bond's credit spread increased by only 1 percentage point, it would produce a 20% profit in price for the position. To see a 1 percentage point increase at some point would be unlikely to surprise anyone; a move like this had already happened many times in recent memory.

We concluded that paying out a mid-1% annual premium to get this 20% profit potential was not only an excellent hedge to protect the portfolio, it was a great investment in its own right.

To execute this view, we hand-picked a collection of 38 expensive, long-dated investment grade credits to sell against treasuries via ‘portfolio trades’. The position was exceptionally liquid. It was diversified. It consumed no capital. And it consumed very little margin. For a higher resolution view, please see our Q2 2021 LP Letter.

In the second half of the year, markets softened as the omicron variant proliferated. Contributions from security selection among long positions, and early gains from our investment grade credit hedge provided stable returns through this time.

And by year-end 2021, the Fund produced a net return of +8.3%.

2022

In the spring, the rapid reappraisal of inflation and central bank tightening by interest rate markets caused price declines across all asset classes. With stocks down, it was not a surprise to see credit spreads widening, allowing our portfolio hedge to contribute very well early in the year. By May, the corporate spread hedge had served its purpose and we monetized profits.

The continued change in interest rates and the price of credit produced a new opportunity set by the fall of 2022, leading to natural changes in the portfolio. Through the year, investment in our own purpose-built technology and systems enhanced our ability to identify event-driven opportunities. At this time, we found many of the most promising opportunities in the investment grade space as underpriced optionality was abundant, due to these bonds’ large discounts to par.

In addition, we reallocated a material portion of our Canadian convertible debentures into more liquid, deeply discounted convertibles in the US, most of which also contained exceptional takeout optionality.

These two changes also combined to increase the average issue size held in the portfolio, positioning us with even more flexibility as we moved through what looked like the unpleasant front edge of a credit cycle.

By the end of 2022, these historic moves in interest rates and rough credit conditions took a devastating toll on almost every facet of the fixed income market. Our hedges in investment grade and favorable bond-picking contributed greatly to results in the year; the Fund produced the strongest year of relative outperformance in its history at +6.5% versus High Yield. Unfortunately, our High Yield and Investment Grade benchmarks were down 11.2% and 9.9%, respectively. And, for the first time measured by a calendar year, the Fund declined in value. For a higher resolution view, including top contributors and unforced errors, please see our 2022 Letter.

In 2022, the Fund declined by 4.5%.

2023

As we moved through 2023, we exited the bulk of our event-driven investment grade bond investments in favor of more attractive US-based convertible bond opportunities.

In the convertible bond market, we were finding many liquid credits with management teams continuing to pivot further to debt-friendly capital allocation and operating policies. In addition to these bonds being well-supported by this fundamental and technical dynamic, technology-focused private equity sponsors continued to circle the space, underpinning the hidden option value in the convertible bond contracts' "Fundamental Change" (change of control) covenant.

We ended 2023 with a defensive posture given our high liquidity, low duration and equity hedges.

In 2023, the Fund returned +10.3%

And that was our past three years together.

Growth in our Capacity

At its most abstract, the foremost pre-requisite for generating great investment results is the capacity to produce commercial insight. If this is true, an investment manager’s focus should, perhaps to the exclusion of almost anything else, be dedicated to the design and implementation of an approach to produce and capitalize on such insight. We published a thoroughly-defined investment philosophy at the Fund’s inception, but beginning in 2021, we finally denied the Tyranny of the Urgent to evolve this area so fundamental to our work. Since this time, we have invested time redesigning, rebuilding and then refining our systems “stack” more than in all prior years combined. Our ongoing iteration and implementation continues to this day.

Combined, these systems have enhanced how and where we gather data, how we convert this data into information and commercial insight and how and where we engage in the market.

Our differentiated returns over the past three years are a testament to this new convergence of technology and judgement. In addition, groundbreaking advances in software copiloting models have also enabled us to seamlessly iterate.

The most exciting area of our work is in finding new ideas. We have deployed several, internally-developed systems to this end, which provide diversified on-ramps for idea generation. These systems increase our ability to consistently find what we call “high-potential anomalies” - situations worth investigating.

By way of a yard-sale metaphor, we've now got a high-resolution drone that, on any given Sunday, can help us spot the Patek Nautilus or Group of Seven amongst Rick's old VHS tapes, bowling trophies and mannequin heads.

Our favorite product that we have developed is our X-Ray tool, which allows us to perform 'deep scoping' work on prospective investments. The analytics span a variety of user-defined dimensions such as security valuation and corporate governance. It also includes a risk/reward landscape, expressed in 3-D space. Bloomberg, Capital IQ, Factset all do not have this functionality in fixed income, so we built it ourselves. Now we are finding these anomalies in a fraction of the time it took previously. At its core, we are tapping into more and higher quality ‘looks’ at what’s out there. This resource not only helps us compound our pattern recognition but it also allows us to raise our bar for what constitutes a great investment. We are heartened to know there’s lots of tread left on the tires of this new technology and we are leaning into this with all we have.

Outlook

It is hard to predict the weather of tomorrow, but it can be instructive looking out the window to see what’s actually here. What we are seeing is overall financial conditions that are fairly tight. We are seeing bankruptcies on the rise. And interest rate markets tell us we are on the eve a cutting cycle across multiple central banks. These factors do not obviously point to - at least initially - a rosy outlook for risk markets.

But our response to this is the same as it always has been: own bonds at valuations that should compensate us well even in the event a difficult environment comes to pass, and find hedges with positive expected value.

Perhaps most important is that the hand of interest rates has shaken the snow globe mightily for the last two years and today, we see a market of bonds containing plenty of situation-specific opportunities. The portfolio yields in the 7 percent range, has strong capital appreciation potential and we are thoroughly constructive on our ability to enhance your investment’s value in 2024. In a world where investors expect 10% from equities, we are not alone in our view that the high yield space is a very competitive alternative to equities at this point in the cycle. When we add to this possible positive surprises in the portfolio due to corporate actions, we can’t help but to look forward to the year ahead.

Thank you for your continued confidence.

Next in the Series

2024 Q1 Letter

Dear Limited Partners of the Ewing Morris Flexible Fixed Income Fund,

In the first quarter of 2024, the Flexible Fixed Income Fund Returned +2.3%. This return favorably compares to our publicly traded high yield and investment grade benchmarks, which returned +0.8% and 0%, respectively.

Since its inception in early 2016, the Fund has delivered a compound annual return of 6.1%, meeting our long-term return expectations of 5% to 7% and exceeding our benchmarks by a meaningful margin

Free Options on Valuable Change

This year, corporate executives and investment bankers threw a party. M&A volume was up 70% year-over-year in the first quarter. This dynamic was, and continues to be, a welcome development for the fund.

It is welcome because we hold many discounted bonds where if there is a change in ownership of the issuer, the bonds are required to be paid back in full. For a bond trading at a discount to its principal value, this kind of event can pull years of return forward. It is a best-case scenario for bond investors.

So what does it take to be exposed to such a pleasant outcome?

Finding Riches in Niches

Carefully watching for situations that have potential for change is a good start. Sometimes the only thing preventing a corporate sale is sufficient shareholder and board resolve. It turns out that the mental framework of finding signs of emerging power imbalances can produce strong bond investments.

When shareholders get sufficiently energized and step into their power to make change, big events like a corporate sale or divestiture can happen. When a big event happens, it is natural for a bond contract to be implicated. This is usually a good thing for the owner of the bond. It is good for the owner because the owner typically gets back at least 100 cents on the dollar. In a situation like this, a bond priced at a deep discount is typically the best to own to monetize the event.

To this end, we have been increasingly investing in situations featuring shareholder displeasure. The first quarter was host to big events at some of our ~30 portfolio companies. Let us tell you about a couple of them.

Techtarget

We made our investment in Techtarget’s convertible bonds due in 2026 at a price averaging under 80 cents on the dollar in early 2023. Techtarget is a digital media publisher. The day we bought the bonds, shareholders were upset. The stock was down 15% on the day on account of the company reporting disappointing earnings. And, from its 2021 high, the stock was down 62%.

This displeasure was made evident in June of 2023, when the company disclosed its proxy voting results. Shareholders had voted 20% against its directors (on average) and 35% elected ‘against’ on the company’s say-on-pay advisory vote.

So, Techtarget’s leadership chose to do something. On January 10th, 2024, the company entered into a transaction with Informa PLC. As a consequence of this transformative merger, Techtarget bonds are set to receive 100 cents on the dollar - a 25% gain from the purchase price we had made in the prior year.

Catalent

We made our investment in Catalent’s Senior Unsecured bonds due in 2029 and 2030 at a price averaging less than 79 cents on the dollar in May of 2023. Catalent is a drug manufacturer carrying an enterprise value of more than $10B. The day we bought the company’s bonds, the stock was down 77% from its pandemic highs and was in the midst of operational mishaps, financial pressure and accounting delays. The pain was palpable as the embarrassment. The day prior to our first purchase marked the stock’s post-pandemic low of $31.86.

Given the board’s weak position, the company’s size, reasonable balance sheet, and prior media speculation of interest from Danaher, it was no surprise to us that by August the company counted an activist - Elliott Management in this case - as a new prominent shareholder. The two parties signed a cooperation agreement and four new directors were added to the board.

On February 5th, 2024, Catalent press released an agreement to be purchased by Novo Holdings for $63.50. The transaction appears to implicate our bonds’ covenants and the market expects them to be redeemed above 100 cents on the dollar at close, representing a return of more than 27% from our purchase price.

Thank you for your investment in the Ewing Morris Flexible Fixed Income Fund.

You’re Invited To Join the Conversation

Explore Our Full Library

Library

2025 Annual Letter

Minimizing Tax Drag (Part 2)

Minimizing Tax Drag (Part 1)

Select Credit Fund LP